The accounts receivable management (ARM) industry learned some new terms just a few years ago: call blocking and call labeling. This year, the new term you need to be aware of is “text blocking.” It seems that at least one major carrier has declared debt collection texts off-limits, regardless of procedures or level of compliance.

[article_ad]

insideARM recently received a copy of T-Mobile’s Code of Conduct (also referred to as the “Guidelines”), dated November 2020. The document is provided as a compliance and best practice guide to facilitate “high-quality, high-integrity business communications, not SPAM or unconsented messaging” by those who use the T-Mobile Commercial Messaging network.

T-Mobile’s stated goals are to:

- Protect subscriber from unwanted messaging while providing growth for the messaging ecosystem;

- Design minimal, common-sense policies;

- Empower consumer choice;

- Support transparency and open communication with businesses; and

- Stay flexible, so that rules can adapt and evolve.

The Guidelines are meant to supplement the most recent CTIA Short Code Monitoring Handbook as well as the CTIA Messaging Principles and Best Practices (the “CTIA Handbook”) and state that where the two conflict, the T-Mobile Guidelines take precedence.

Non-compliance with the Guidelines may result in

- Suspension of sending rights for a provisioned shortcode, longcode or Toll-Free numbers;

- Restriction daily quota message buckets for 10DLC services;

- Suspension of provisioning rights for new phone numbers; and/or

- Suspension of all network services.

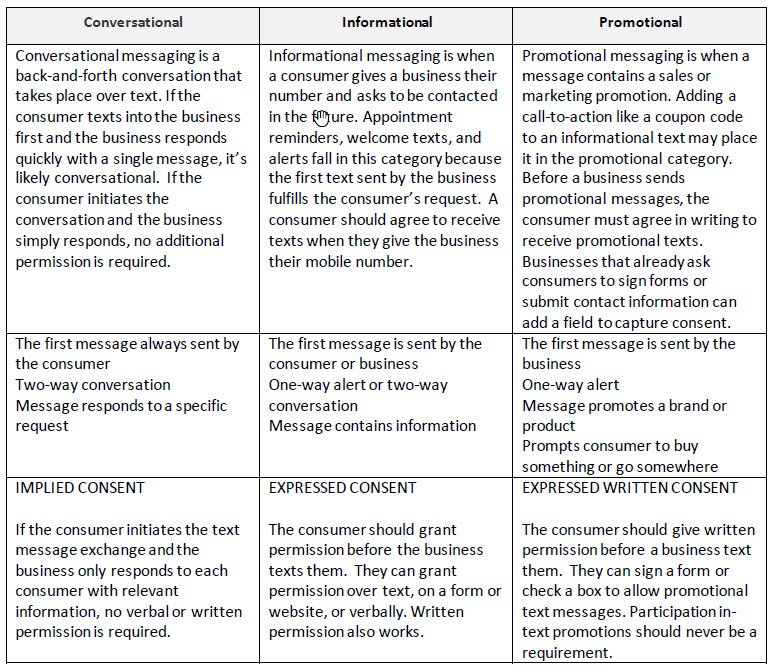

The Guidelines specifically outline definitions and consent requirements related to conversational, information, and promotional messages. For those unfamiliar, debt collection communications fall under the “information” category.

The Guidelines also identify activities T-Mobile considers compliance flags, and which will be flagged and monitored for action:

- High Opt-Out Rates – including a suggestion of immediate suspension (and potentially blocking of numbers) of a message campaign for opt-out rates greater than 4% opt-out within 24 hours.

- Filter Evasion Assistance (sending strategies designed to evade SPAM controls) – including a prohibition of the practice of automatically providing a sender with new phone numbers to replace phone numbers blocked by a receiving network.

- Dynamic Routing (each 10DLC, Shortcode, and Toll-Free number must have a single route in the delivery path to the destination phone number)

- Number Cycling (the practice of using a number until it begins to show signs of deliverability degradation, then discarding the number for a new one).

Finally, the Guidelines specifically define “Disallowed Content”.

The following content categories are considered deceitful and nuisance campaigns which may result in high volumes of SPAM complaints on the T-Mobile network. Due to these issues, we will no longer support any campaign under the following categories, regardless of any prior approval. Messaging use cases that support the disallowed content outlined below may request an official exception in writing by T-Mobile through an official T-Mobile exception approval process. Any exception that existed before September 1, 2020, should be considered invalid.

Such categories include:

- Payday Loans

- Non-Direct Lenders

- Debt Collection

- Debt Consolidation

- Debt Reduction

- Credit Repair Programs

- Cannabis

- Illegal Prescriptions

- Work from Home Programs

- Job Alerts from 3rd Party Recruiting Firms

- Risk Investment Opportunities

- Gambling

- Any other illegal content

- Lead generation indicate the sharing of collected information with third parties

- Campaign types are not in compliance with the recommendations of or prohibited by the CTIA

- Campaign types not in compliance with the recommendations of or prohibited by the CTIA Messaging Principles and Best Practices – 2019 version

insideARM also received a copy of AT&T’s Code of Conduct, dated June 2020. Most of the guidelines are the same/similar, however, as of the version of the document we obtained, AT&T is not expressly prohibiting debt collection content. Their prohibited list (with any exceptions requiring written approval) is shorter than T-Mobile’s:

- Loan advertisements with the exception of messages from direct lenders for secured loans

- Credit repair

- Debt relief

- Work from home, ‘secret shopper,’ and similar advertising campaigns

- Lead generation campaigns that indicate the sharing of collected information with third parties

- Campaign types not in compliance with the recommendations of or prohibited by the CTIA Short Code Monitoring Handbook, Version 1.7 or later.

Sources tell insideARM that Verizon also wrestled with this issue in the past but has not taken the extreme position that T-Mobile has. Sprint (now owned by T-Mobile) has so far remained independent and not adopted the same policy, but MetroPCS (also owned by T-Mobile) has adopted it.

Debt collectors have been texting consumers for quite a while under certain circumstances, such as sending required payment reminders, and they follow all required rules and laws. Nonetheless, will these messages, specifically requested by consumers, now be blocked by T-Mobile and MetroPCS?

It seems text originators would be well-advised to discuss this matter with their platform provider to understand any potential impact. insideARM will continue to follow this matter.

![Stephanie Eidelman [Image by creator from ]](/media/images/Stephanie_Eidelman-12.8.19.7e612703.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)