Merger and acquisition activity in the ARM industry is showing signs of picking up after lull due to increased regulation and market uncertainty. If the flurry of transactions already seen in the debt buying sector in 2014 is any indication, we should fasten our seatbelts because we’re in for quite a ride.

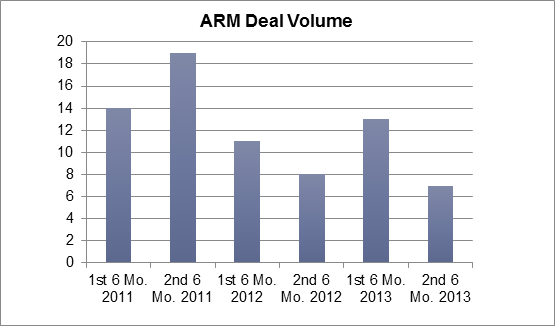

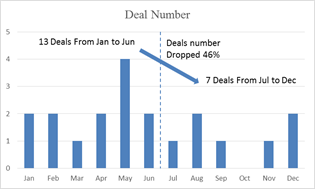

Let’s take a quick look back before examining current activity and developing trends. The 18 months dating back from the middle of 2011 to the end of 2012 could be viewed as a period of uncertainty in the U.S. ARM industry as increasing regulatory scrutiny combined with business volume declines specifically in the bank card sector caused some buyers to sit on the sidelines, revise their pricing and/or deal terms to account for perceived transaction risk, or simply take longer to work through due diligence or secure outside financing.

In 2013, buyers and sellers remain cautious but continue to pursue M&A transactions in the ARM industry. In 2013, there were 20 M&A transactions announced in the ARM industry.

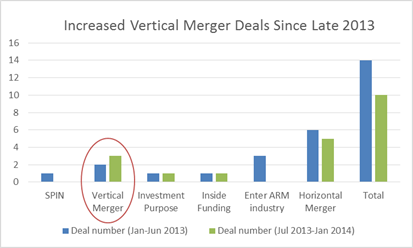

The most common type of deal during the first half of 2013 was industry buyer expansion (referred to as horizontal mergers), accounting for 38% of all transactions during this time period, in the second half of the year there was an upward trend in vertical mergers, illustrating more sector consolidation.

Starting in 2013, we experienced an uptick in transactions involving debt buyers. Encore Capital Group (NASDAQ: ECPG), a leading U.S. debt purchasing company, announced at the end of May that they entered into an agreement to purchase a controlling interest in U.K. based Cabot Credit Management, marking the first time a U.S. debt buyer made a significant acquisition of another debt buying company based in Europe. This came on the heels of Encore’s announcement to purchase Asset Acceptance.

At that time, we forecast that the ARM industry would experience more U.S. companies acquiring companies based outside the U.S. to fuel expansion efforts. However, we did not expect the magnitude of transactions to follow.

Portfolio Recovery Associates (NASDAQ: PRAA) announced in February that it would acquire Norway-based debt buyer Aktiv Kapital for $1.3 billion. This announcement came after Encore Capital Group’s announcement that it will acquire UK-based debt buyer Marlin Financial Services for £295 million (approximately $481 million) and finish buying the rest of Cabot it did not purchase previously.

On the debt buying front, we expect more transactions involving small and mid-size debt buyers exiting by divesting their portfolios to larger debt buyers. However, sellers will have to produce nearly complete data in order for industry buyers to satisfy the needs of the CFPB when purchasing debt portfolios in the secondary market.

Other Trends Developing on the M&A Front

As the healthcare sector continues to evolve in the Obamacare era, we expect to see more M&A transactions involving smaller and mid-size healthcare market specialists. Larger players will also participate as evidenced by Parallon’s purchase of The Outsource Group last year.

Increased regulation will accelerate consolidation within the U.S. ARM industry. Some smaller and mid-size players, battling escalating operating costs and client demands, will find it more challenging to remain independent and may look more favorably toward a sale. Larger companies are not immune from this trend as evidenced by the sale of public company Asset Acceptance, once a market leading debt buyer, to Encore Capital as noted earlier.

Some ARM companies focused on the financial services sector are making acquisitions a part of their growth strategy in a move to diversify their client base and expand their service offerings, a trend we expect to pick up steam. This was apparent in Enhanced Recovery (ERC)’s acquisition of TMone, LLC, a rapidly growing company in the Business Process Outsourcing (BPO) space.

We are also seeing significant interest in purchasing ARM companies in the government and student loan sectors from non-industry (financial and strategic) and industry participants which will add to the overall number of transactions completed in the ARM sector in 2014 and beyond.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)