We can sum up the current playing field in accounts receivable management (ARM) in one word: Dynamic. From technology advances, to regulatory oversight, to client demands, to consumer actions, the ARM industry is rapidly evolving and it is challenging for collection professionals to keep up.

In the second of a three-part blog series, I will take a snapshot of the current playing field of ARM. (Part I, The History of the ARM Industry, can be found here)

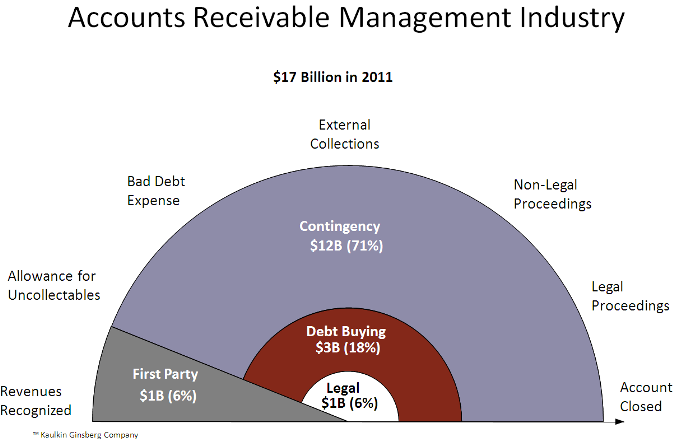

Using various sources of data, we approximate the North American ARM industry to have generated $17 billion in revenues in 2011.

Nearly three quarters of this revenue comes from debt collection work done on a contingency basis. The second largest segment is debt buying at 18%. The rest is comprised of legal collections and first party collections, evenly split at 6%, as shown in the chart below:

Here are some fast facts of interest to recovery managers, collection professionals and vendors alike:

-

There are approximately 5,500 ARM companies in North America. Most of these are collection agencies focused on contingency collections.

-

Less than 100 ARM firms have annual revenues of $20 million or more.

-

According to ACA International, the industry employs some 140,000 professionals

-

I stated that debt collection topped the list of consumer complaints in 2011, some 180,000 in all, when in fact they ranked second behind identity theft at nearly 280,000. Revisit insideARM’s Complaints Big Issue for the inside scoop.

On the federal regulatory front, the hot topics include:

-

CFPB’s proposed “supervisory rule”, geared toward financial services focused collection agencies and debt buyers with $10 million or more in “gross receipts”.

-

The Telephone Consumers Protection Act (TCPA) restricts use of auto-dialer or prerecorded messages to call a consumer’s cell phone, failing to appreciate significant advances in technology and consumer tendencies.

-

Changes to statutory periods in certain states, impacting collection of out-of-stat (OSS) accounts.

-

Collectors rely upon the transfer of consumer account information to effectuate collections once an account becomes delinquent; Truth in Lending Act to be re-evaluated.

At the state level, many state Attorneys General have been aggressive in their pursuit to levy suits against collection agencies and debt buyers. Generally, legislative efforts seem centered around:

-

Resident manager/in-state office requirements

-

Licensing requirements

-

Regulation – proposed new regulations to the industry, in particular debt buying

-

Debt verification / documentation – seeking consumer protection by mandating account details

-

Time barred debt

-

Data security

-

Identity theft

Snap shot completed. Next time I will look toward the future of ARM.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)