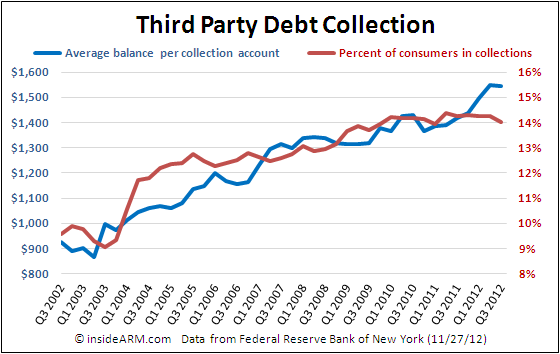

The percentage of Americans with at least one account in third party collections fell in the third quarter of 2012, according to the Federal Reserve Bank of New York. The average account balance of those in collection also decreased slightly.

In its Quarterly Report on Household Debt and Credit for the third quarter of 2012, the Federal Reserve Bank of New York noted that 14 percent of American consumers had an account in the third party debt collection system, down from 14.25 percent in the second quarter. Since peaking at 14.38 percent in the second quarter of 2011, the percentage of consumers in collections has steadily fallen.

The average balance of accounts in third party debt collection also fell slightly to $1,546 in Q3 2012 from $1,550 in Q2 2012. The decline represents a slight correction in account balance since a precipitous rise that began in the second quarter of 2011 when the average balance for collection accounts was $1,389.

The Quarterly Report on Household Debt and Credit is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative random sample drawn from Equifax credit report data. During the third quarter of 2012, total consumer indebtedness shrank $74 billion to $11.31 trillion, a 0.7 percent decrease from the previous quarter. The reduction in overall debt is attributed to a decrease in mortgage debt ($120 billion) and home equity lines of credit ($16 billion), despite mortgage originations increasing for a fourth consecutive quarter.

But non-real estate household debt jumped 2.3 percent to $2.7 trillion. The increase was due to a boost in student loans ($42 billion), auto loans ($18 billion) and credit card balances ($2 billion).

“The increase in mortgage originations, auto loans and credit card balances suggests that consumers are slowly gaining confidence in their financial position,” said Donghoon Lee, senior economist at the New York Fed. “As consumers feel more comfortable, they may start to make purchases that were previously delayed.”

The stunning revelation in the report, however, was a massive spike in student loan 90+ day delinquencies. In the third quarter of 2012, 11 percent of student loans were 90 days or more past due, up from 8.92 percent in the second quarter.

The NY Fed attempted to explain the jump thusly:

Outstanding student loan debt now stands at $956 billion, an increase of $42 billion since last quarter. However, of the $42 billion, $23 billion is new debt while the remaining $19 billion is attributed to previously defaulted student loans that have been updated on credit reports this quarter. As a result, the percent of student loan balances 90+ days delinquent increased to 11 percent this quarter.

The report also ominously noted that many student loans are still in grace periods, deferments, or forbearance, and thus not included in the delinquency measure as they are not officially in the payment cycle. But they are still counted in the total universe of student loans. So the rate of delinquency among student loans in the payment cycle might actually be twice as high…somewhere around 22 percent.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)