The CFPB has announced it will be looking at racial issues and will be taking an active role in addressing issues of pervasive racial injustice and the long-term economic impacts of the COVID-19 pandemic on consumers. On April 28, 2021, the CFPB issued a press release announcing it analyzed county-level demographic data coming from complaints for racial disparity. Additionally, on June 3, 2021, Acting Director Uejio released this video discussing the CFPB’s intentions to take action against racial injustices toward consumers.

Where did this come from?

While the complaint bulletin linked in the CFPB’s press release does not state the specific reason for the CFPB’s focus on race, it does note that the CFPB received over 700,000 consumer complaints since the declaration of the COVID-19 pandemic on March 13, 2020.

The video linked above provides further insight. At the start of the video, Acting Director Uejio opines that “Our nation is in the midst of a long-overdue conversation about race.” Then, after citing his personal experiences with racism, mentioning widely publicized racial issues which took place over the past year, and noting that other bureau members know what it’s like to face discrimination, Acting Director Uejio states unequivocally that the CFPB is “working hard to protect all consumers against discrimination.” The video concludes with a commitment from Acting Director Uejio that “the CFPB will take action against institutions and individuals whose policies and practices prevent fair and equal access to credit or take advantage of poor, underserved, and disadvantaged communities.”

How did the CFPB analyze the data and what did it show?

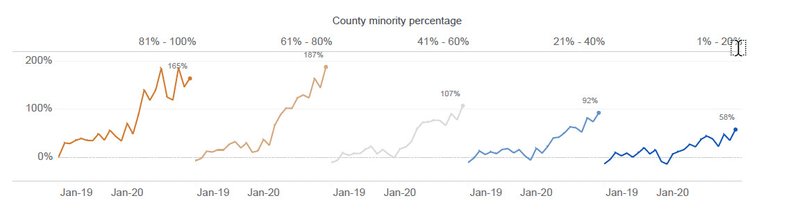

Although the CFPB does not collect race and ethnicity information in the complaint process, consumers provide their mailing addresses. To evaluate the communities that were filing the most complaints, the CFPB used race and ethnicity estimates from the U.S. Census 2019 American Community Survey coupled with the consumer’s mailing address to group each of the more than 3,000 counties in the United States into five separate categories. The categories were 1%-20% minority, 21%-40% minority, 41%-60% minority, 61%-80% minority, and 81%-100% minority. The CFPB referred to those counties where the minority (non-white or Hispanic) populations make up more than 61% or more of the total population as “predominantly minority counties.”

According to the CFPB’s analysis, it received more complaints per capita from consumers living in minority counties, and the largest rate of increase between 2019 and 2020 came from minority counties. These results did not change based on product line; all product lines, including credit reporting and debt collection, followed these trends. Further, from 2019 to 2020, complaints increased at a greater rate in predominantly minority counties compared to predominantly white, non-Hispanic counties.

The chart below shows the complaint volume percentage increase by minority volume category, indexed to the 2018 complaint average.

Regarding the analysis, CFPB Acting Director Dave Uejio stated, “Consumer complaints support and inform the CFPB’s work, and provide key insight into emerging trends in the financial marketplace. …Today’s report shows that while all people across the nation face financial hardships, a significantly higher rate of complaints come from ethnically diverse communities. The data raise concerns that deserve our further study and, as such, we’ll keep a spotlight on patterns or any abuses we see.”

What is the CFPB Going to do about it?

To study these issues and attempt to understand the experiences of diverse communities in the consumer marketplace, the CFPB plans to enhance the consumer complaint form to allow consumers to enter household size and household income information. The CFPB will also explore what additional demographic information may be appropriate to collect via the complaint process, such as race and ethnicity. The CFPB believes these enhancements will help it better understand who submits complaints today and how that changes over time. Further, the CFPB expects this work to help illustrate the life-cycle of consumer credit from originations through collections and credit reporting to understand consumers’ diverse experiences in the marketplace.

insideARM Perspective:

Although the complaint bulletin acknowledges that the county-level demographics analysis provides only a “high-level overview” and has certain limitations, it does appear the CFPB considers its analysis to show a trend. We’re not quite sure yet what this means for those in the accounts receivable space, but when the CFPB states it has a specifically focused initiative it will be pursuing, such as this one, those entities which interact with consumers should pay attention. We will bring you more information on this emerging initiative from the CFPB as it develops.

![Missy Meggison [Image by creator from ]](/media/images/Missy_Meggison_8PYANpG.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)