Yesterday the Consumer Financial Protection Bureau (Bureau) issued a report examining the early effects of the COVID-19 pandemic on consumer credit. Based on credit record data, the Bureau’s research found that consumers have not experienced significant increases in delinquency or other negative credit outcomes since the onset of the COVID-19 pandemic. The report focuses on mortgage, student and auto loans, and credit card accounts from March 2020 to June 2020.

According to the report,

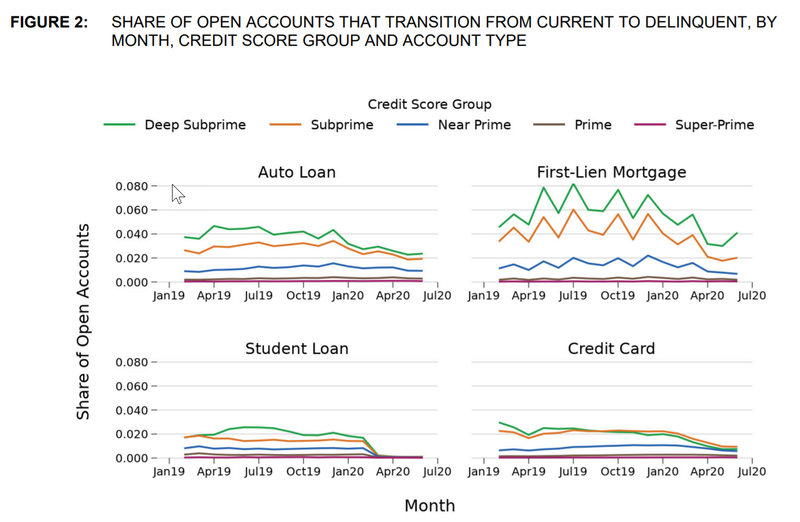

- The reported rate of new delinquencies on mortgage loan, auto loan, student loan, and credit card accounts fell between March 2020 and June 2020, after being flat or increasing gradually for the year prior. The reported share of already delinquent accounts that became more delinquent also fell. Breaking our sample out by credit score and demographics, the reported share of new delinquencies fell for all groups.

- Beginning in March of 2020, there was a sharp increase in the share of accounts reported with zero payment due despite a positive balance, indicating some type of payment assistance. This was most pronounced for mortgages, where we observe around 6 percent of all outstanding first-lien mortgages reporting zero payment due by June 2020, up from essentially zero in February 2020.11 Assistance was more likely to be reported for borrowers residing in areas with more COVID-19 cases, with majority-Black or majority-Hispanic populations, and with larger changes in unemployment since the start of the pandemic.

- There was a slight reduction in the availability of credit card debt between March and June 2020. Credit limits on existing credit cards declined slightly, where prior to March 2020 there was a general trend of increasing limits. There was also an uptick in the closure of accounts by credit card issuers. In absolute terms, borrowers with very high credit scores accounted for the majority of account closures.

- Consumers did not appear to be accumulating credit card debt as a means of staying afloat financially. On average, credit card balances decreased by around 10 percent between March 2020 and June 2020, a drop consistent with other data that show a decline in consumer spending. Moreover, when we break out our sample by credit score and consumer demographics, we find declines in balances across all groups, including consumers residing in both high- and low-income census tracts.

Clearly, the CARES Act is largely behind these results. The report notes that the Act generally requires furnishers to report as current certain credit obligations for which they make payment accommodations to consumers affected by COVID-19. Since consumers receiving assistance can maintain a current account status rather than go, delinquent, the expectation is that there will be fewer month-to-month transitions into delinquency than would have been the case absent the CARES Act provisions. This is especially true for student loan accounts, for which the CARES Act automatically suspended payments and mandated furnishing requirements that apply to more than two-thirds of the market from March through September 30, 2020. On August 8, President Trump directed the Secretary to continue to suspend loan payments, stop collections, and waive interest on ED-held student loans until Dec. 31, 2020.

In addition to the aggregate study, the Bureau examined results by credit score group. The table below reflects their finding no evidence that delinquencies on major forms of credit increased during the early months of the COVID-19 pandemic, in contrast to the U.S. experience in the Great Recession.

Source: Consumer Financial Protection Bureau

The Bureau concludes that at least part of the reason for the absence of delinquency impacts is likely the policy interventions at the federal, state and local levels. Beyond direct income supports such as higher unemployment insurance benefits, these policies include programs aimed specifically at providing payment assistance to consumers with certain types of credit.

Worthy of a final note is that the CFPB acknowledges what they consider to be important limitations of the study, due to its reliance on credit reporting data to be timely and accurate. Additionally, the report notes that the results only represent the experience of consumers with a credit report–roughly 90 percent of adults in the United States—and only with respect to those types of credit the Bureau focuses on. It's important to highlight that this report does not examine medical debt.

iA Perspective

So, what does this portend for the debt collection industry over the coming months? In the early months of the pandemic, there was a clear trend of consumers using their available cash -- whether from the CARES Act, a reduction of spending, or other sources -- to pay down delinquent debts...for some debt types. This was positive for the industry, creditors, and consumers alike. No matter the reason, many consumers are in a better financial position, at least at the moment. This could mean that for at least some time, there will be a reduction in accounts placed with collection agencies.

Some suggest that, once the effects of the stimulus funds' July 31st end take effect, the delinquency picture will begin to look different, especially if the unemployment rate does not begin to fall. At a minimum, it seems that the future story for the debt collection industry will vary greatly by industry.

As for medical debt, this story has yet to play out. While hospitals have been extremely busy in recent months, they've been servicing Covid patients. President Trump has said the government will pay those bills. And Congress has kind of said that consumers won't have to pay those bills. Kaiser Health News reported at the end of May that "Since the passage of the Families First Coronavirus Response Act (FFCRA) on March 18, most people should not face costs for the COVID-19 test or associated costs." Most people. Should not. I think this story is yet to fully play out. What's also happened is that thousands of would-be patients put off routine or non-Covid-related procedures. So it will take time to replenish that receivables pipeline.

As for federal student loan debt collectors, the story has been disastrous. I predict there will be unintended consequences for consumers arising from the implementation of some elements of the CARES Act. As I wrote in this article back in June, the Act prohibited Private Collection Agencies from sending collection letters or making outbound collection calls to defaulted federal student loan borrowers, which means PCAs may not reach out to borrowers to inform them, for instance, that $0 payments to an Income-Driven Repayment Plan during the forbearance period would apply towards the requirement for forgiveness. But the borrower must be fully enrolled with completed documentation. The only way a borrower could learn about them is if they happen to read the FAQs on the Federal Student Aid website. This will only come to light months from now when it's too late.

![Stephanie Eidelman [Image by creator from ]](/media/images/Stephanie_Eidelman-12.8.19.7e612703.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.jpg)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)