Yesterday, we read the attention-grabbing headlines about the largest TCPA settlement ever paid by credit and collection professionals for allegedly using auto-dialers and/or pre-recorded messages in calls to cell phones without the consumers’ express consent.

What the headlines fail to acknowledge is that by levying such outrageous fines our shockingly pro-consumer regulators are failing to recognize the rapidly changing landscape of the American phone user and the essential need of superior collection techniques to help restore our essential credit economy.

Let’s lay out the facts that regulators appear to be overlooking:

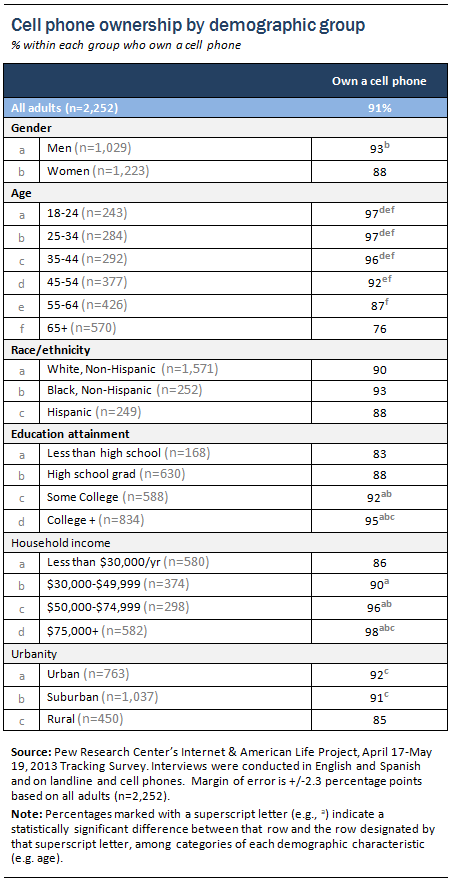

As of January 2014, 90% of American adults had a cell phone.

According to a 2012 National Health Interview Survey (NHIS), 36 percent of American adults live in a home with wireless service, but no landlines. Tack on another 16 percent who have a home phone that they seldom use in lieu of the cell. The only reason I have a home phone is because FIOS throws it in for free with my internet and cable package.

The number of Americans abandoning their landline phones continues to increase. In the second half of last year, 36.5 percent of adults lived in wireless-only households. The change is more dramatic when viewed through a wider time window: Just three years ago, 24.9 percent of adults lived in cell-phone-only households, according to data collected by the Centers for Disease Control and Prevention during the first half of 2013.

This chart illustrates how widely utilized cell phones are in the US alone.

The growing number of U.S. consumers in the debt collection system.

More than 35 percent of U.S. adults with a credit report have accounts that qualify to be in some stage of the debt collection system, according to a joint study from the think tank Urban Institute and debt buyer Encore Capital Group last week named “Delinquent Debt in America.”

The average balance of those accounts is $5,178.

In addition to traditional financial debt (credit cards, bank loans, etc.), the study found medical debt, utility bills, membership fees, phone bills, and many other kinds of debt being reported as charged-off on credit reports.

The authors noted that even the 35.1 percent figure is a bit too low; some 22 million low-income adults do not have credit files and were not represented at all in the study.

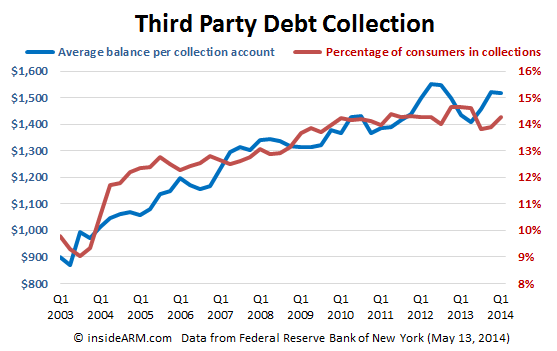

The Federal Reserve Bank of New York also keeps tabs of Americans in the collection system, but they track only those accounts placed with third parties (the Urban Institute/Encore study also tracked first party collection efforts). Even third party debt collection numbers are substantial and largely growing:

So, the facts are clear:

- There are a growing number of consumers in collections with an increasing outstanding balance.

- Nearly all US consumers regardless of demographic use their cell phones and not their landline.

Instead of levying outrageous fines, perhaps our elected officials can explain to lenders and businesses across America how they can effectively communicate with their customer about their obligations when the laws fall behind technology advancement?

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)