Consumer attorneys are filing new class action lawsuits asserting that debt collector emails are being sent before 8 a.m. or after 9 p.m. in violation of the FDCPA. While debt collectors must adhere to the time restrictions for sending debt collection emails, it will be impossible for the consumer attorneys to certify any FDCPA class action asserting that a debt collector sent emails at an inconvenient time because email providers routinely delay the delivery of emails. As discussed below, this delay between when a debt collector sends an email and when the consumer receives the email necessitates an “individualized inquiry” to establish standing for each potential class member which will defeat any class action.

Time-Restrictions on Sending Debt Collection Emails

The Consumer Financial Protection Bureau articulated in Regulation F that debt collection email communications violate 1692c as inconvenient if they are sent before 8 a.m. and after 9 p.m. local time for the consumer. Regulation F further provides that “an electronic communication occurs when the debt collector sends it, not, for example, when the consumer receives or views it.”

Consumer attorneys are now asserting putative FDCPA class action lawsuits against debt collectors premised on the time that an email was received by the consumer. However, the time that a consumer receives an email is often different from the time that the email was sent by the debt collector, sometime by many hours.

How to Identify Email Delivery Delays to Defeat a Class Action

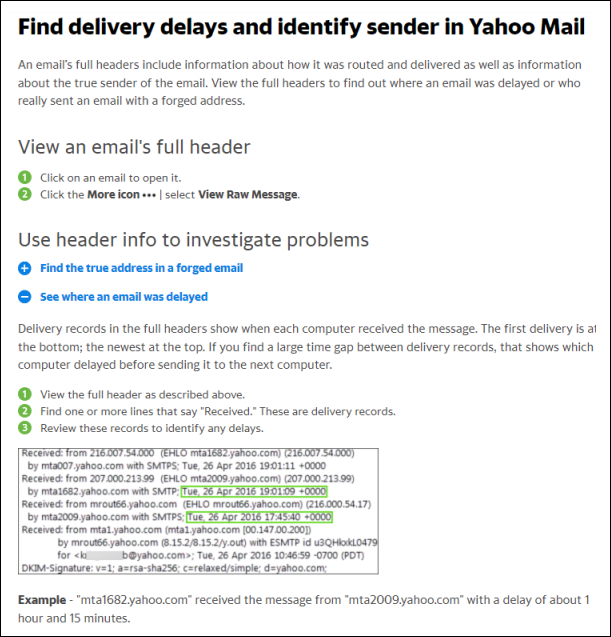

An email that a consumer receives utilizing the Yahoo email platform does not, on its face, always disclose the actual time that the email is sent despite including a “time sent” field in the email. Yahoo publishes the following information on its website to assist consumers with accessing the “full header” on an email to determine how long an email was delayed:

In the example published on the Yahoo website above, the email is delayed “for about 1 hour and 15 minutes.” However, the recipient of the email would be unaware of this delay unless the recipient took the multiple steps outlined on the Yahoo website to access the “full header” for the email. Gmail likewise uses “predelivery scanning” to delay certain email messages before delivery, in some cases for hours.

Email Delays Necessitate Individualized Standing Inquiries, thus Defeating Class Certification

While Regulation F provides that “an electronic communication occurs when the debt collector sends it,” the United States Supreme Court held in Ramirez v. TransUnion that each consumer seeking to participate in a class action must suffer some “concrete injury.” This standing requirement of a “concrete injury” is problematic for any FDCPA class action alleging that debt collection emails were sent at an inconvenient time because the receipt of emails are frequently delayed. How could a potential class member in an FDCPA lawsuit establish any “concrete injury” if a debt collection email that was sent at an inconvenient time is received by the consumer’s computer at a convenient time due to delivery delays by the email carrier?

Thus, to determine whether a consumer qualifies as a member of any potential class action asserting that debt collection emails were sent at an inconvenient time, an individualized inquiry must be conducted to determine if the email was received at an inconvenient time by each member of the potential class due to email delays. For potential class members with a Yahoo email address, the multi-step process described on the Yahoo website and cited above must be used to identify the sending time in the full header.

Notably, the requirement for an individualized inquiry regarding the actual receipt time of each email for each potential class member defeats the “predominance” or “superiority” element of a class action. The United States Supreme Court has held in Comcast v. Behrend that a class action is improperly certified if individual questions overwhelm questions common to the class.

Conclusion

Any company facing class allegations that it sent debt collection emails at an inconvenient time – whether those allegations arise under the FDCPA, the Florida Consumer Collection Practices Act or some other law – should consider whether delays in email delivery may defeat these claims.

![John Rossman [Image by creator from ]](/media/images/JKR_photo.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Thumbnail_Background_Packet.max-80x80_af3C2hg.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)