The holiday break saw several high-profile articles in major national publications that took square aim at the accounts receivable management industry and some of the practices used to collect debts. Leading the charge was business behemoth The Wall Street Journal.

From December 23 through the last day of 2011, the Journal published four articles on debt collectors, including two feature pieces. The first article, “Debts Go Bad, Then It Gets Worse,” explores recent trouble Capital One has had in bankruptcy courts. The card issuer has been accused of pursuing accounts that were discharged in bankruptcy actions. But the article takes a turn and focuses on the practices of the entire ARM industry, singling out debt buyers.

The next week, on December 28, The Wall Street Journal ran “Judge Says Widow Harrassed,” which in fairness, was a news article about an actual event: a Florida judge ruling that Bank of America and West Asset Management had run afoul of various laws in attempting to collect the debts of a deceased man from his widow. The case is civil in nature, but could set a precedent when a jury decides on an award later this year.

After a brief look two days later at the burgeoning debt collection industry in Brazil, the Journal published a feature length article on New Year’s Eve that explored the practice of offering new credit to consumers in return for settling old debts. The piece, “Bringing Expired Debt Back to Life,” focuses on the world of out-of-statute collections and some of the methods employed by creditors and debt collectors to “re-age” debt that is close to expiring. The article casts a skeptical eye on some of the practices, but interestingly, features several quotes from consumers that welcomed the opportunity to receive additional credit.

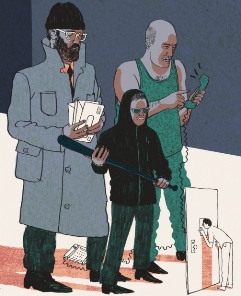

Not to be outdone, Newsweek magazine is running a 2,600-word feature in its current edition titled simply, “America’s Abusive Debt Collectors,” complete with a cartoon (seen at right) featuring a hopeless consumer beset by collectors.

Newsweek’s article, published in conjunction with newly acquired The Daily Beast, is a no-holds-barred takedown of an entire industry. Using interviews with former collectors, the magazine takes on complaints, debt buyers (“pennies on the dollar!”), and even the most basic of debt collection practices and techniques. And, of course, consumer stories are featured prominently.

It should come as no surprise that the media is taking big swings at the ARM industry. And maybe collection professionals should feel lucky that the stories were published at a time that can be described as a dumping ground. But the sheer volume of the articles and the size of the publications in which they ran might be cause for concern when looking at the landscape in 2012.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)