Recently, InsideARM.com conducted a survey of the ARM industry to better understand how creditors, collectors, debt buyers and legal recovery firms were levering the newly regulated debt settlement industry to improve collections. With 649 ARM professionals responding to this survey, one thing that was immediately apparent is that the debt settlement industry is on the radar of ARM professionals.

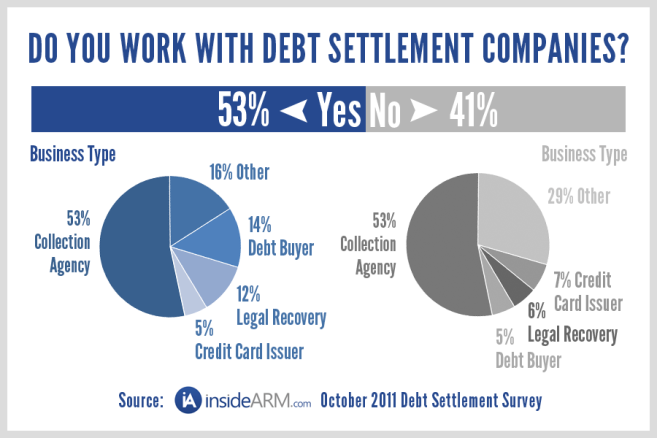

With roughly half of the survey participants indicating that they currently work with the debt settlement industry today, we are seeing the beginning of a clear trend developing towards acceptance of this channel and the adoption of its use to increase liquidations.

Agencies are clearly leading the way in the paradigm. Collection agencies outnumbered debt buyers 3:1 and legal recovery firms 4:1 in working with the debt settlement industry. Understandably so, creditors still rank among the lowest in terms of firms utilizing this channel today, but insideARM. com believes even this group is showing signs of early adoption around this asset class.

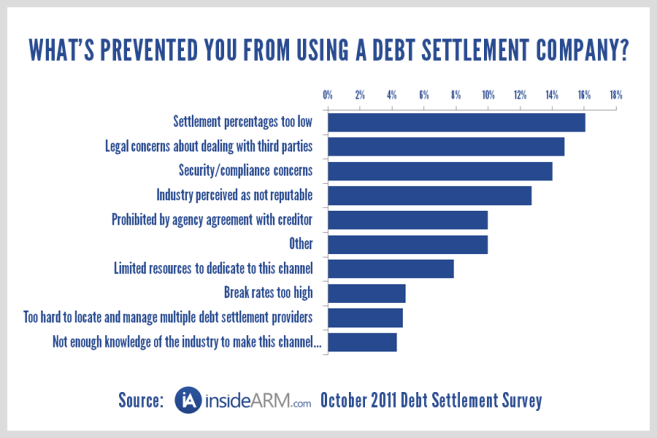

It appears from the results of the survey, as well as the numerous comments provided by respondents, that the concerns about reputational credibility of the industry and the past practices by bad actors (now legislated in a manner designed to strictly mitigate future offenses) has taken a back seat to liquidation performance and concerns around data security, privacy, compliance, and the FDCPA. The top three reasons provided for not working with the debt settlement industry related to these issues while concerns around reputation came in fourth, with only 13% of participants stating reputation as a concern.

One of the most telling pieces of data to come out of the survey centered on a proposed solution to many of the top concerns noted by the survey participants. When respondents were asked if they would reconsider their decision to work with debt settlement companies if provided a secure, compliant, aggregated data repository of debt settlement accounts, nearly half said they would change their decision to work with the industry, further demonstrating that security, compliance, and scalability in leveraging the debt settlement industry all were more important than the perceived reputation of the industry as a whole.

To download the entire debt settlement survey, go to http://www.insidearm.com/freemiums/debt-settlement-industry-collections/

To learn more about Persolvo Data System’s web-based debt settlement database and settlement system Concerto 3.0, visit www.Persolvo.com, or contact Ed Fontaine, VP of Sales at efontaine@persolvo.com to learn how you can scrub up to 100,000 accounts for free to see just how many settlement opportunities are in your portfolios. Visit us at the DBA, February 7-9 in Las Vegas at booth #335.

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)