Last week we talked about how to decide if you should sue a business for unpaid invoices. We focused on Return on Investment (ROI) as the primary criterion. This week we are discussing facts and circumstances to consider when evaluating ROI and how ROI expectations have changed over the last few years.

Since the beginning of the financial crisis in 2008, we have seen five major changes impacting key factors in the ROI equation on many of the cases we evaluate:

- The Real Estate Bust

- Weaker Economy

- Improvement in Information Availability

- Slower Court Process

- Higher Court Costs

Business owners are far more likely to own real estate than the average American. This used to be a positive indicator that an owner had personal assets available that they could tap to cover business obligations. Even if our clients didn’t have a personal guaranty, we could expect that eventually during the judgment collection process, we could put so much pressure on the business that the owner would prefer to inject personal funds instead of having business assets seized. Many business owners had used historical profits to finance real estate investment beyond their primary home, giving them more personal assets to access as our pressure increased.

Unfortunately, with the real estate bust, we now find that owning real estate often is just another source of financial hardship and pressure on the business owner, making the likelihood of actually collecting lower rather than higher. And if they never owned real estate, it typically means their finances were weak during the real estate bubble. If they were weak then, in most cases they probably haven’t improved since the bust and the financial crisis. This means we need to look at the business as the primary source of potential recovery in a much larger percentage of cases instead of the owner’s personal assets.

While corporate profits have completely recovered for the majority of publicly traded large companies, the weak economy continues to take its toll on smaller businesses. Many have been struggling since late 2008, a four year battle to stay afloat. Others became entrepreneurs as a last resort – they couldn’t find a job. In those cases, they may have had limited financial resources when they started or perhaps didn’t have all the experience one would prefer a business owner to have, leading to bad decisions and financial distress.

If the consensus was that the economy was on a strong upward trend, then we would expect the prospects of many of these businesses to improve, and therefore a higher likelihood of eventually collecting during the litigation process. In 2007 there was wide confidence that doesn’t exist today which lowers the average prospects of recovery.

Another big change is the continuously improving availability and authority of information via the Internet and subscription databases. In last week’s column, we discussed factors to be considered that impact the likelihood of collecting through litigation. It is now much easier to get some or all of this information than it was previously — if you know what to look for and how to look for it. For our firm, it has led to fewer lawsuits being filed, as we are able to determine that recovery is extremely precarious or doubtful in many of the cases we evaluate. However, in the cases where we recommend litigation, we now typically have more information available for our clients which increases their confidence in the decision to proceed.

The declining financial health of state and local governments has also had a negative impact on the ROI equation in two ways. First, budget restraints have resulted in layoffs within many court districts resulting in the litigation and collection process taking more time. The longer it takes, the more likely a weak business will be gone by the time we can begin various judgment collection activities. And ROI, by definition, is lower when it takes more time to get the return. We have two short videos on our website on collection litigation and judgment collection for those who are not that familiar with the process.

Second, courts have also increased the price of filing fees and other services they provide to deal with their budget issues. As client’s face rising litigation costs, many potential cases no longer make sense from an ROI basis. When it only used to cost $200 to file suit, so little was at risk that clients would pursue even small or marginal cases. But with costs often ranging from $500 to $1,500 for mid-size claims, our clients are no longer willing to litigate many of the smaller or weaker cases.

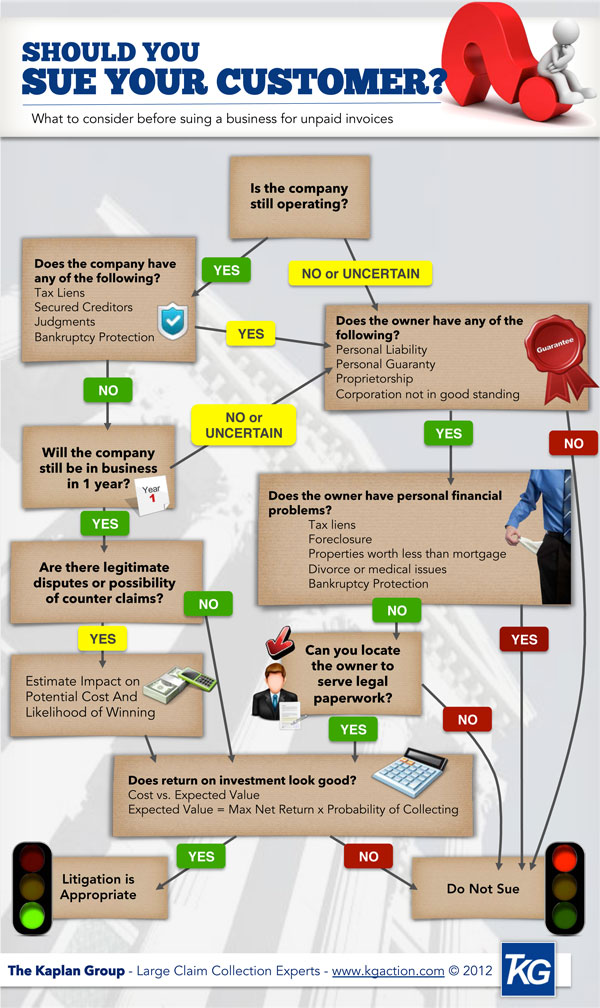

We don’t mean to be all doom and gloom about collection litigation. It is an important tool which we use frequently. At the same time, when making business decisions, we encourage our clients to use all available information and recognize that circumstances have changed since the financial crisis.  We have created the graphic below to help guide clients through the process of determining if they should file a lawsuit when all other avenues have failed to resolve the collection problem. We encourage readers to comment below – share your experiences with collection litigation and other items to consider when deciding if litigation is appropriate.

We have created the graphic below to help guide clients through the process of determining if they should file a lawsuit when all other avenues have failed to resolve the collection problem. We encourage readers to comment below – share your experiences with collection litigation and other items to consider when deciding if litigation is appropriate.

Click on the infographic to see the larger version:

To embed the image on your own site, use this code:

<a href="http://www.kaplancollectionagency.com/resource-center/should-you-sue-your-customer"><img title="Should You Sue Your Customer?" src="http://www.kaplancollectionagency.com/wp-content/uploads/2012/09/should-you-sue-your-customer-infographic.jpg" alt="Should You Sue Your Customer?" width="600" height="1008" /></a>

<p>Source: <a href="http://www.kaplancollectionagency.com/resource-center/should-you-sue-your-customer">Should You Sue Your Customer?</a> was produced by the team at <a href="http://www.kaplancollectionagency.com">The Kaplan Group</a>.</p>

Source: Should You Sue Your Customer? was produced by the team at The Kaplan Group.

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)