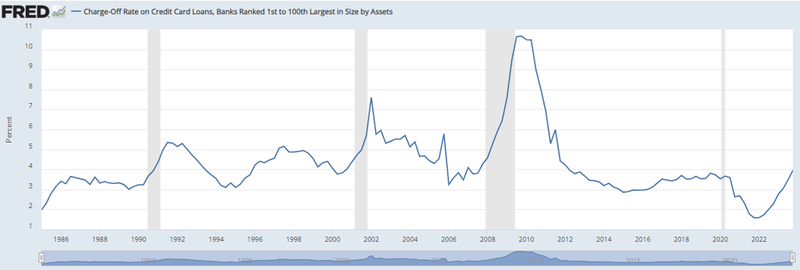

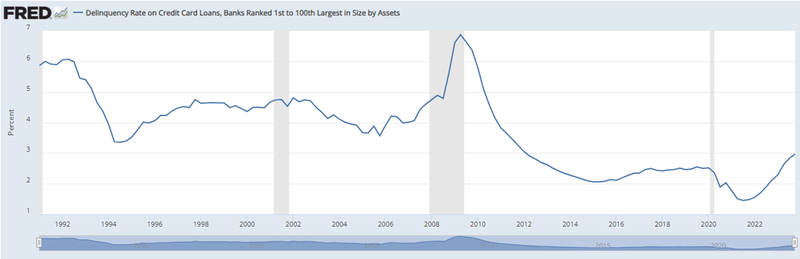

The Federal Reserve just released its fourth quarter 2023 credit card charge-off and delinquency data with both reaching a 12-year high.

The charge-off rate increased from the third quarter’s 3.48% to 3.96%, for the first time surpassing the pre-pandemic level of 3.65%. The delinquency rate increased from 2.83% to 2.97%. The delinquency rate is often an early indicator of the future charge-off rate. The Q4 trend suggests a continued increase in charge-off volume should be expected, although the rate of that increase may be leveling off as the increase slowed.

Another observation is that for seven years before the pandemic the delinquency rate stayed in a narrow 2.0 - 2.5% band. This band was at a lower rate than several previous decades of data. Now for three quarters, the delinquency rate has been above this pre-pandemic seven-year band.

The Federal Reserve’s charts for the data referenced follow. The charts are easily downloadable in several formats.

Charge-off Rate on Credit Card Loans

Deliquency Rate on Credit Card Loans

![Joel Rosenthal [Image by creator from ]](/media/images/Joel_Rosenthal.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)