U.S. consumer credit outstanding in March grew at the fastest rate since 2001 as Americans used their credit cards and took out other loans at a dizzying pace, the Federal Reserve reported late Monday.

Overall credit expanded by $21.4 billion – or at a 10.2 percent annualized rate — in March, the most in a single month since November 2001. Much of the gain was attributable to increases in non-revolving debt outstanding, mostly comprised of auto and student loans. These closed-end loans grew at an 11.3 percent annual rate in March.

The federal government saw the fastest growth of major debt holders in the Fed’s monthly consumer credit report (also called the G.19). Due to the expansion of growth in non-revolving loans held by the government, student loans appear to be the main driver of the March gains.

Credit card debt also expanded at a near-record rate. Consumers added some $5.1 billion to credit card balances in March – an annual growth rate of 7.8 percent – after beginning 2012 with two straight months of decline. Going back to 2008, there has been only one month (November 2011) with faster credit card debt growth.

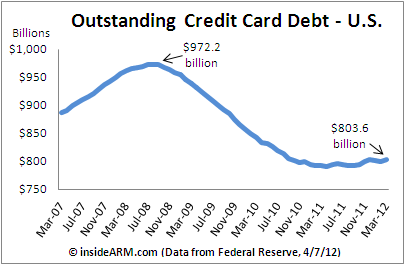

Total credit card debt outstanding was $803.6 billion at the end of March 2012, still far below the peak of $972.2 billion in September 2008. After the credit crisis of that year, credit card debt outstanding plunged as bank maniacally charged-off old card balances and tightened lending standards, stunting card growth. Total credit card debt outstanding has struggled to stay above $800 billion since late 2010.

Total credit card debt outstanding was $803.6 billion at the end of March 2012, still far below the peak of $972.2 billion in September 2008. After the credit crisis of that year, credit card debt outstanding plunged as bank maniacally charged-off old card balances and tightened lending standards, stunting card growth. Total credit card debt outstanding has struggled to stay above $800 billion since late 2010.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)