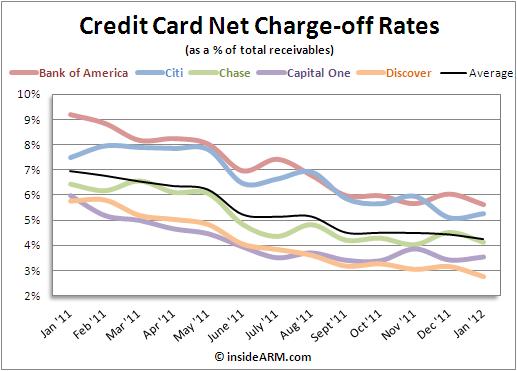

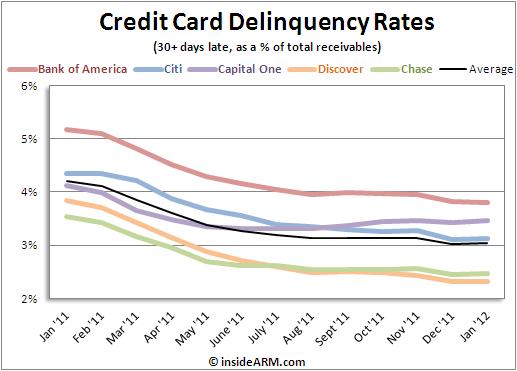

The average net charge-off rate for the credit card portfolios of five of the largest U.S. card issuers fell in January after remaining flat for four months. The average delinquency rate was nearly unchanged.

The decline in the average credit card charge-off rate was driven largely by substantial declines in the Bank of America, Chase, and Discover portfolios. Citibank and Capital One reported modest increases compared to December 2011. Major banks file with the SEC their securitized credit card portfolio performance on a monthly basis.

The average charge-off rate among the five issuers was 4.26 percent in January 2012, down from 4.45 percent in December and 6.97 percent in January 2011. The securitized pool average charge-off rate peaked at 10.31 percent in May 2010.

Bank of America reported the highest net charge-off rate (which is defined as credit losses for the month minus recoveries from collection activity) at 5.63 percent, while Discover reported the lowest rate at 2.75 percent.

Average delinquencies in the credit card portfolios increased very slightly to 3.03 percent in January from 3.02 percent in December. Delinquency rates among the issuers are much more tightly clustered than charge-offs with Bank of America reporting the highest rate of 3.80 percent and Discover enjoying the lowest rate at 2.47 percent.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)