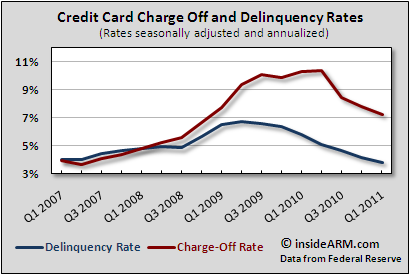

The average delinquency rate in the first quarter of 2011 for consumer credit card accounts was the lowest since the first quarter of 2006, according to the Federal Reserve.

In data released late last month, the Fed said that the average delinquency rate on credit card accounts among its member institutions was 3.83 percent, down from a peak of 6.74 percent in the second quarter of 2009. The average delinquency rate was 4.15 percent in the fourth quarter of 2010.

Not only is the delinquency rate for cards the lowest in recent history, it’s also one of the lowest average quarterly rates since the Fed began tracking the metric in 1991.

Credit card chargeoffs also fell in the first quarter of 2011 to a rate of 7.22 percent, down from 7.80 percent in the previous quarter. Credit card chargeoffs have driven much of the decline in outstanding credit card debt in the U.S. with the rate peaking at a previously-unthinkable level of 10.73 percent in the second quarter of 2010.

The average credit card charge off rate for Fed member banks stayed above 10 percent for four straight quarters before starting to decline in the third quarter of last year.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)