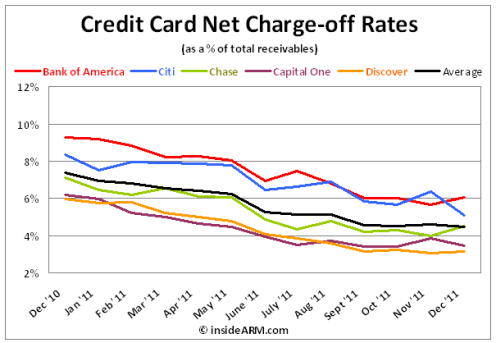

Three out of five major U.S. credit card issuers saw significant increases in December in their net charge of rates, according to SEC filings. But the average credit card charge-off rate fell compared to November, the direct result of Citibank reporting a huge drop in December.

Bank of America, Discover, and JP Morgan Chase reported increases in their net credit card charge-off rates among their securitized debt trusts. Capital One reported a decrease in their rate. Citi said that its charge-off rate fell to 5.11 percent in December after a 6.36 percent rate the previous month.

Citi’s large movement drove down the average charge-off rate among the five issuers to 4.45 percent from 4.59 percent in November.

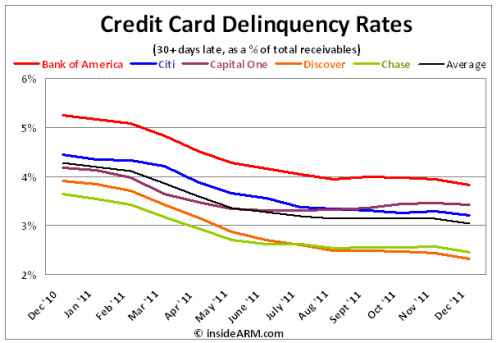

The average 30+ day delinquency rate continued to decline in December, reaching a multi-year low of 3.05 percent in the last month of 2011.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)