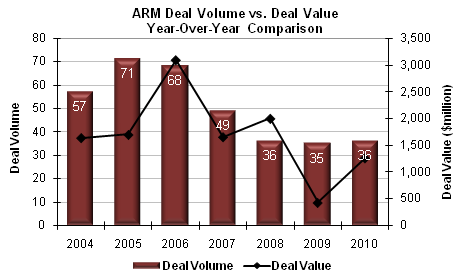

Rockville, MD – While the number of mergers and acquisitions in the ARM industry remained relatively flat in 2010, total deal value increased significantly as buyers reacted positively to improvements in financial performance and increased activity by senior and mezzanine lenders. 36 M&A transactions were completed in 2010 representing $1.265 billion in total deal value, compared to 35 transactions and $432 million in total deal value in 2009, a 193% increase in total deal value.

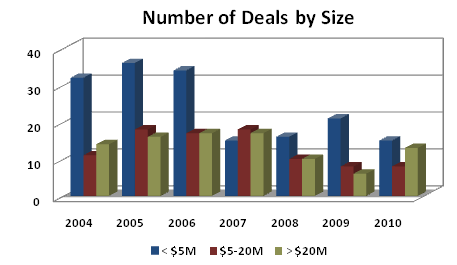

According to Mark Russell, Director of Kaulkin Ginsberg, “In 2009, 60% of the completed transactions involved smaller ARM companies (< $5M in purchase price); in 2010, only 42% of the transactions fell into this category (see chart below). While smaller transactions have historically represented a sizable if not the majority of total deal volume per year, 2009’s results were impacted by a higher than normal amount of transactions involving distressed ARM companies. Distressed deals also occurred in 2010, but the volume dropped significantly and was replaced by transactions involving larger companies with stronger financial performance.”

Russell also notes that there was increased interest from all buyer types in 2010 – strategic, financial and industry buyers, a trend that Kaulkin Ginsberg expects to continue in 2011. According to Russell,” Strategic and financial buyers focused on larger platform acquisitions (> $20M in purchase price). The volume of larger deals in this category more than doubled from 6 in 2009 to 13 in 2010.”

Noteworthy transactions involving strategic and financial buyers included: 1) RLJ Equity’s recapitalization of Enhanced Recovery Corp; 2) Huntsman Gay’s recapitalization of IQOR and subsequent acquisition of Receivables Management Services (RMS); 3) Duke Street Capital’s recapitalization of UK based Black Tip Capital; 4) Aditya Birla Minac’s acquisition of Bureau of Collection Recovery (BCR); and 5) H.I.G. Capital’s recapitalization of Trak America and subsequent acquisition of Pinnacle Financial Group through its NARS portfolio company.

Industry buyers were also active in 2010, and focused on transactions of all sizes. Notable transactions involving industry buyers included: 1) Receivables Outsourcing Inc.’s acquisition of The Arc Group; 2) Intrum Justitia’s (STO:IJ) acquisition of the Nordic collection operations of Aktiv Kapital (AIK:NO) and the Swedish debt purchasing company Nice Invest Nordic AB; 3) Portfolio Recovery Associates’ (NASDAQ: PRAA) acquisition of Claims Compensation Bureau, LLC; and 4) EOS/Collecto’s acquisition of True North AR.

The Outsource Group and First Financial Asset Management were also active industry buyers in 2010, each acquiring multiple ARM companies throughout the year.

The increased level of buyer interest had a positive effect on acquisition multiple ranges for strong performing ARM companies. We have also seen a greater use of deal structure in the form of retained equity, seller’s notes and earn-outs particularly with sellers that have heavy client concentration or that operate in markets with fluctuating business volumes such as the credit card sector.

“The next twelve months of ARM M&A activity will be active and most likely reflect the trends that we have seen unfold in 2009 and 2010”, according to Russell. “While we expect to experience further consolidation of ARM companies in certain markets such as the credit card and healthcare sectors, we also anticipate increased interest from strategic and financial buyers in certain markets such as commercial, student loans and government services.”

Russell believes that the primary factors impacting M&A activity within the ARM industry will be company performance and regulatory/legislative changes. According to Russell, “For owners who are contemplating a sale of their business over the next twelve months it is imperative that they focus on maintaining strong financial and competitive performance as well as being vigilant about regulatory compliance. Deterioration of performance and/or regulatory compliance issues will be major red flags to buyers.”

Contact:

Mark Russell, Director

Tel: 240-499-3804

mark@kaulkin.com

About Kaulkin Ginsberg

As the leading strategic advisor for the accounts receivable management industry (ARM), Kaulkin Ginsberg has completed over 130 M&A transactions valued at over $3 billion. Services focus on analysis, growth, and exit strategies for ARM companies. InsideARM is the worldwide leader in providing timely news and insight on the recovery of debt in all industries. Read more about Kaulkin Ginsberg at www.kaulkin.com.

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)