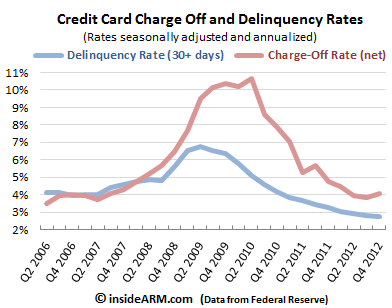

The U.S. Federal Reserve said Tuesday that charge-offs of credit card accounts among its member banks increased more than five percent in the fourth quarter of 2012, the first time aggregate charge-off rate for cards has grown in a year-and-a-half. Credit card delinquencies, meanwhile, declined in the quarter to an all-time low.

The Fed said in its quarterly Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks data release that the average charge-off rate for credit card accounts was 4.06 percent in the fourth quarter, up from 3.86 percent in Q3 2012.

The 4.06 percent charge-off rate is near long-term averages but down sharply from the high of 10.65 percent set in the second quarter of 2010. The average charge-off rate of Fed member institutions has fallen precipitously since that period.

After the financial crisis in the fall of 2008, banks charged off credit card accounts at a record pace, with four straight quarters of 10 percent+ average charge-off rates. As banks tightened lending standards for all loans and rolled back credit card lines, write off rates declined.

After the financial crisis in the fall of 2008, banks charged off credit card accounts at a record pace, with four straight quarters of 10 percent+ average charge-off rates. As banks tightened lending standards for all loans and rolled back credit card lines, write off rates declined.

Delinquencies among credit card accounts hit a new 22-year low in the fourth quarter of 2012 of 2.73 percent, declining from 2.82 percent in the third quarter.

Late payments on home loans, however, continued to be stubbornly high, with Fed member banks reporting an average 10.07 percent delinquency rate for real estate loans, which includes home equity lines of credit and first mortgages. The fourth quarter of 2012 marked the 13th consecutive quarter that the residential real estate loan delinquency rate has been above 10 percent.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)