Twenty-six percent of women in the United States have had “serious difficulty” paying medical bills, a new study has found.

The Commonwealth Fund, a not-for-profit research group, has been an active advocate of US healthcare reform via the Patient Protection and Affordable Care Act (PPACA) and this most recent research study supports the group’s assertion that “reform is helping.”

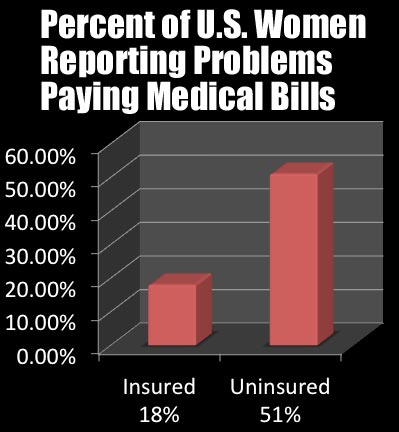

A survey of US women covering the year 2010 found that more than half (51 percent) of women without insurance or who only had coverage for part of a year could not promptly pay their medical bills. The study also found that 18 percent of women — nearly one in five – with insurance had difficulty paying medical debts.

Almost 40 percent of women incurred medical expenses greater than $1,000 in 2010, according to the study, and both insured and uninsured women reported similar out-of-pocket medical expenses for the year.

According to the study, while the vast majority of women in the US have some form of medical insurance, 18.7 million women do not, a 50 percent increase since 2000. The study also compares insurance coverage and ability to pay of women in other industrialized countries and finds coverage for women in the US significantly lacking.

According to the study, while the vast majority of women in the US have some form of medical insurance, 18.7 million women do not, a 50 percent increase since 2000. The study also compares insurance coverage and ability to pay of women in other industrialized countries and finds coverage for women in the US significantly lacking.

Last month the Commonwealth Fund released a similar study, except that it focused on young adults. Some 36 percent of young adults, male and female, reported problems with medical debt, the study found.

[For a copy of the results of the Commonwealth study — “Oceans Apart: The Higher Health Costs of Women in the U.S. Compared to Other Nations, and How Reform Is Helping” – download this pdf]

![[Image by creator from ]](/media/images/2015-04-cpf-report-training-key-component-of-s.max-80x80_F7Jisej.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)