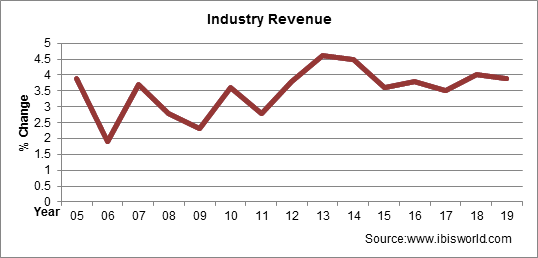

From 2008 to 2013, healthcare industry revenues grew at an annual rate of 3.4%. It is expected to continue expanding at an annual rate of 3.9% up to the year 2018.

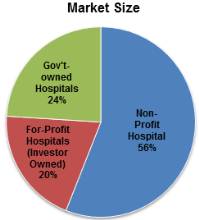

The hospital market is comprised of non-profit hospitals, for-profit hospitals, and government owned hospitals. There are currently 2,903 non-profit hospitals, 1,025 for-profit hospitals and 1,253 government owned hospitals. The largest share of the market is comprised of non-profit hospitals at 56%.

The hospital market is comprised of non-profit hospitals, for-profit hospitals, and government owned hospitals. There are currently 2,903 non-profit hospitals, 1,025 for-profit hospitals and 1,253 government owned hospitals. The largest share of the market is comprised of non-profit hospitals at 56%.

A recent analysis of this market segment conducted through the University of Maryland Research Fellowship Program sponsored by Kaulkin Ginsberg found:

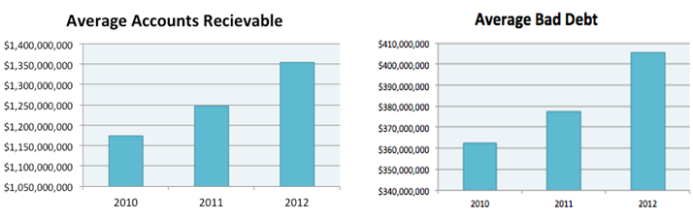

- The revenue of almost every hospital group evaluated increased from 2010 to 2012. From 2010-2011 the revenue grew at a rate of 5.49%, and from 2011-2012 it grew at an even higher rate of 7.79%. This indicates that the revenue was not only increasing, but it was doing so at an accelerated rate.

- The accounts receivable and bad debt levels have been increasing at a solid rate according to the collective average of the sample of non-profit hospitals evaluated. Approximately 5% of revenue is written off annually as bad debt.

- When the Great Recession first “began” in 2008, the number of people enrolled in private health insurance decreased, a trend that continued as the recession worsened in the ensuing years. Funding for public insurance (Medicare and Medicaid) increased during the same time as the number of people left the private insurance market and entered public market.

- While currently there is no benchmark for non-profit hospitals to meet, from the hospitals examined, there was an increase in the charity contribution rate over the past three years. Despite this trend, the charity contribution rate is expected to decline in the upcoming years due to Obamacare, as it requires individuals to purchase insurance, consequently reducing the need for non-profit hospitals to provide free healthcare.

- Hospitals receive federal funding to offset the cost of uncompensated care. Under Obamacare, federal funding will be cut by up to $155 billion in order to expand healthcare coverage. If non-profit hospitals cannot cover the cost of uninsured patients, they will have to find a new way to supply a community benefit or risk losing their non-profit status.

- Financial incapability of operation caused by lower revenue, resulting from lower reimbursement rates, may push some non-profit hospitals to merge with or be sold out to larger non-profit hospital groups, even to for-profit hospital groups.

A detailed report is being compiled and will be released to Kaulkin Ginsberg clients shortly.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![[Image by creator from ]](/media/images/2015-04-cpf-report-training-key-component-of-s.max-80x80_F7Jisej.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)