After breaking a 27-month losing streak in December 2010 with a small gain, consumer credit card debt outstanding fell by more than four percent in February, extending the new losing streak to two months, according to data released late Friday by the Federal Reserve.

In its monthly Consumer Credit statistical release (G.19), the Fed reported a $2.7 billion decline in revolving debt outstanding, which is almost entirely comprised of credit card debt. The measure fell at an annualized rate of 4.1 percent after increasing at a 3 percent rate in December 2010 but sliding 5.9 percent in January 2011.

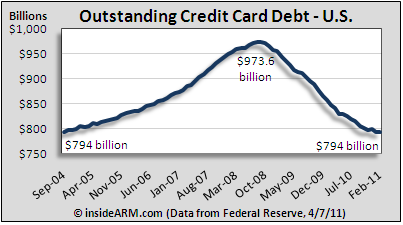

Total consumer credit card debt outstanding was $794 billion in February, down from a peak of $973.6 billion in August 2008.

Total consumer credit card debt outstanding was $794 billion in February, down from a peak of $973.6 billion in August 2008.

Non-revolving debt – principally made up of closed end accounts like student and auto loans – increased in February at an annual rate of 7.7 percent ($10.3 billion), the largest gain in three years. Non-revolving debt was buoyed in the month by auto lending, according to the Fed. Total consumer credit, including credit cards, increased at a 3.8 percent annualized rate, the largest overall gain since October 2008.

Total outstanding debt in the U.S. was $2.42 trillion in February. The Fed’s G.19 numbers do not include debt backed by real estate.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)