Healthcare providers can expect to bear a greater portion of medical expenses — that is, medical bills of patients — if health insurance trends identified by the Commonwealth Fund continue.

In a study published yesterday, the not-for-profit Commonwealth Fund found that the costs to workers of employer-sponsored health insurance outstripped growth in wages from 2003 to 2011 by a factor of six. “Annual premium increases for families insured through their employers have far exceeded wage growth for more than a decade—with premiums rising three times faster than wages, adding to the stress of a weak economy,” writes the study’s authors. “Health insurance is expensive and has become less affordable, no matter where one lives. Insurance premiums rose sharply in all states during these eight years and, because wages failed to keep pace, increased as a share of median household income.”

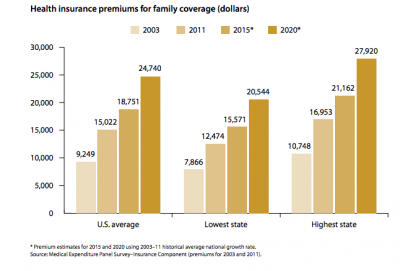

The findings paint a grim picture of the future for healthcare providers. Insurers are under tremendous pressure from employers to contain health insurance costs, and the primary way this has been accomplished has been to shift costs onto employees by way of higher deductibles. As every healthcare provider knows, this tactic actually shifts responsibility to those that provide healthcare services who are charged with collecting these deductibles and out-of-policy fees. The Commonwealth Fund projects that if 5.7 percent average annual growth in health insurance premiums continues over the next decade, the average family will be paying $18,751 in premiums by 2015, and $24,740 by 2020.

Source: Commonwealth Fund (commonwealthfund.org) study, “State Trends in Premiums and Deductibles, 2003–2011.”

If these trends continue to hold true, providers should prepare for the following:

Healthcare providers will be required to continue to collect from more patients a higher percentage of medical costs. “Absent a significant change in the way private insurance and health care markets function, cost pressures will continue to push up private insurance costs and out-of-pocket medical expenses, if the past two decades are any guide,” the study concludes.

Fewer patients will be able to meet their financial obligations related to rising medical costs. From 2003 to 2010, median family incomes grew by 10 percent; inflation grew by 18.5 percent; and medical insurance costs grew by 62 percent. This means family buying power is shrinking, but base medical costs from insurance are consuming a disproportionate amount of income. Insurers therefore are insuring that they will be paid by shifting costs to the consumer, who in turn will have less ability to pay those costs outside of the health insurance plan.

Increased emphasis on higher deductibles means sicker, costlier patients. Overall healthcare volume consumption is down and this has been attributed to higher out-of-pocket costs to consumers. As patients put medical treatment, these will mean more patients will only seek out medical care when symptoms of diseases have progressed beyond tolerance, meaning more expensive treatments.

Healthcare reform will not stem this trend. The Patient Protection and Affordable Care Act (ACA) provides states and the federal government with authority to review health insurance increases, but only if they are “unreasonable,” which is defined as more than 10 percent per year. “As yet, the provision does not apply to grandfathered plans (i.e., those in existence when the Affordable Care Act was signed into law) or plans in the large-group market,” according to the Commonwealth Fund study. And although the ACA explicitly prohibits insurers from charging more than 15 to 20 percent of non-medical costs (administration and profit) to their subscribers, this again puts the burden on providers, who now know that any increase in fees for medical services will automatically have a 15-20 percent uptick by insurers who will pass that on to consumers.

Read it? Love it? Want more of it? Make sure you register on insidePatientFinance.com today for the weekly Patient Finance insider and you won’t miss the ongoing great content from our site!

![[Image by creator from ]](/media/images/2015-04-cpf-report-training-key-component-of-s.max-80x80_F7Jisej.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)