CHICAGO, Ill. -- While nearly all (98%) third-party collections companies use letters to reach consumers, just 40% have adopted text or SMS messaging to consumers—compared to 37% that were using text in 2022. However, last year, 34% indicated they would start using text messaging within the coming two years, suggesting economic headwinds have stalled companies’ planned investments in communications technologies.

The findings were revealed today in the fifth annual industry report by TransUnion (NYSE: TRU) and Datos Insights, “Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023.” The report examines overall collections industry trends, challenges and opportunities and is informed by a survey of third-party debt collection professionals.

“One of the most promising opportunities we see for companies is to invest in omnichannel communications,” said Jason Klotch, vice president of third-party collections in TransUnion’s diversified markets business. “Reaching consumers where they are most likely to respond is the key to effective and efficient operations that also better enable regulatory compliance.”

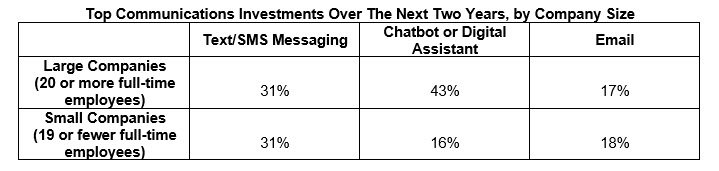

The report found that the willingness and ability of third-party collections companies to invest in new communications channels is largely determined by the size of the firm. Larger firms, with higher budgets and more sophisticated operations, are more likely to adopt new technologies.

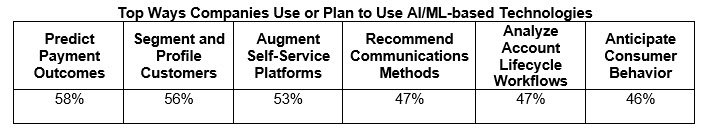

In line with communications investments, the report found 60% of companies are somewhere on the path to adopting tools that leverage artificial intelligence (AI) and machine learning (ML) technologies. That includes 11% of companies that already use third-party solutions, 40% that are considering buying or developing AI and ML solutions and 8% that are in the process of deploying these technologies.

In line with communications investments, the report found 60% of companies are somewhere on the path to adopting tools that leverage artificial intelligence (AI) and machine learning (ML) technologies. That includes 11% of companies that already use third-party solutions, 40% that are considering buying or developing AI and ML solutions and 8% that are in the process of deploying these technologies.

Companies’ applications of AI and ML span internal and external functions. Some use cases will help assess a customer’s willingness to pay. Other applications include enhancing customer experiences by identifying the right time and channel through which the consumer prefers to be contacted.

The challenge for growth

Broader macroeconomic trends have kept consumers generally resilient, tamping down the need for third-party collections activity. Companies recognize the need to gain accounts and expand into new areas of business in order to grow.

The report found that 58% are between moderately and extremely concerned about growing their businesses. Moreover, 64% agree or strongly agree that third-party debt collection firms must diversify their business (e.g., collect different types of debt, expand into other geographic regions) if they are to succeed, thrive, or survive in the long term.

Some of this growth may come from breaking into new verticals, like auto lending or medical debt collection. Another approach is to offer Business Process Outsourcing (BPO) services in which a third-party collections firm helps with processes similar to debt collection, like claims and billing, for businesses within a vertical it already serves.

Both types of expansion were represented in the top two options for growth strategies. Within the next 12 months, 17% of third-party collections companies plan to expand into the FinTech/unsecured consumer lending market, while 12% plan to offer BPO services. Generally, 45% of companies have plans to enter into other types of businesses in the next 12 months.

About the research

Insights on the challenges, trends and innovations occurring in the third-party collections industry are informed by a quantitative survey of 212 third-party debt collection professionals conducted in Q2 2023. A detailed look at the composition of survey respondents is provided in the appendix. Survey results are representative of the market at a 95% confidence interval with a 6.7-point margin of error.

About Datos Insights

Datos Insights is an advisory firm providing mission-critical insights on technology, regulations, strategy and operations to hundreds of banks, insurers, payments providers, and investment firms, as well as the technology and service providers that support them. Comprising former senior technology, strategy and operations executives, in addition to experienced researchers and consultants, our experts provide actionable advice to our client base, leveraging deep insights developed via our extensive network of clients and other industry contacts.

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights company with over 13,000 associates operating in more than 30 countries. We make trust possible by ensuring each person is reliably represented in the marketplace. We do this with a Tru™ picture of each person: an actionable view of consumers, stewarded with care. Through our acquisitions and technology investments we have developed innovative solutions that extend beyond our strong foundation in core credit into areas such as marketing, fraud, risk and advanced analytics. As a result, consumers and businesses can transact with confidence and achieve great things. We call this Information for Good® — and it leads to economic opportunity, great experiences and personal empowerment for millions of people around the world.http://www.transunion.com/business

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)