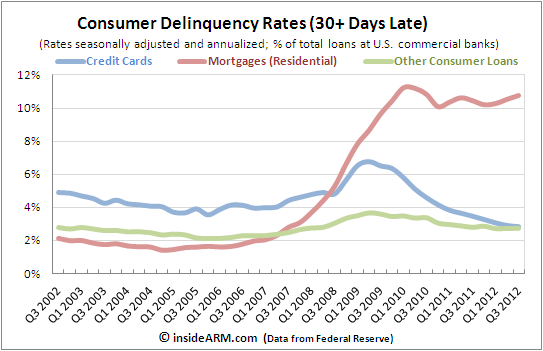

The Federal Reserve recently released its Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks reports for the third quarter of 2012. Consumer credit card delinquency rates set another record for all-time lows while consumer mortgage arrears increased in the quarter to near-record highs.

The Fed data showed that consumer credit card delinquencies among all member banks averaged 2.83 percent in Q3 2012, down from 2.90 percent in the second quarter of 2012. It is the lowest reading ever for consumer credit card delinquencies going back to 1991 when the Fed started tracking that data.

Charge-offs for credit cards also decreased to a seasonally-adjusted average of 3.92 percent, the lowest reading since 2007, before the financial crisis. The charge-off rate fell fairly sharply from 4.18 percent in the second quarter of 2012.

But late payments on consumer mortgages remained stubbornly high. The average delinquency rate for consumer real estate loans — which include home equity lines of credit – increased to 10.77 percent in the third quarter from 10.54 percent in the previous period.

Residential real estate loan delinquencies have now increased in four consecutive quarters. And the 10.77 percent average rate in Q3 2012 is perilously close to the all-time record of 11.25 percent set in the first quarter of 2010.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)