Mike Ginsberg,

Kaulkin Ginsberg

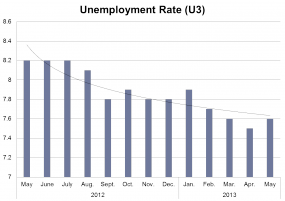

The decreasing unemployment rate continues to be an important barometer for recovery managers and Accounts receivable management (ARM) professionals alike.

In our firm’s latest industry report, Accounts Receivable Management Industry Report, 2013 Midyear Review , available upon request for industry owners and executives at kaulkin.com, we address the impact that unemployment and other important economic indicators are having on ARM.

We also look closely at market level indicators, the landcape for mergers and acquisitions, and with the help of our good friend Rozanne Andersen, describe the impact of regulation on the industry.

Let’s focus on unemployment.

According to a speech delivered by Fed Chairman Ben Bernanke last month, the FED will consider slowing down the pace of its asset purchases if the unemployment rate is “in the vicinity of 7%”.

Following the decreasing unemployment rate trend closely, we anticipate that will happen toward the middle to end of 2014. As the new job positions continue to increase, people are expected to have a higher repayment capacity which means a stronger and more sustainable recovery rates for delinquent debts.

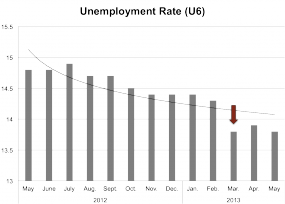

The U6 unemployment rate had a sudden decrease in March 2013 as more and more people found full-time positions rather than part-time jobs. And there is still room for the U6 rate to decrease more significantly than the U3 rate. Historically, the difference between U3 and U6 was 2-2.5% while the recently, the difference has been 6-7%. This positive trend will support the quality and stability of consumer’s repayment capacity.

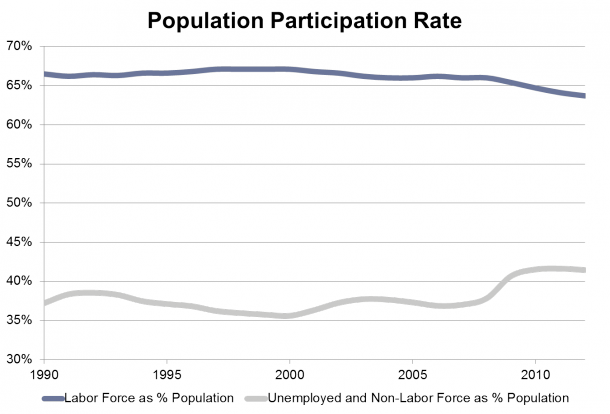

We encourage ARM executives to remain wary about building significant improvements into any financial projections just yet. The labor force participation rate remains in the record low position (as seen in the above graph) so we are not out of the woods yet. Some economists have argued that any recent improvements realized in the unemployment rate are only because of the number of people who are looking for jobs have decreased. For those young or middle-aged people (20-45 years old), some are choosing to postpone the job market and pursue further education, a trend we have experienced over recent years. This has led to an increase in outstanding education loans. There has been a rapid increase in the amount of delinquent education loans in the past 6 months. Before the labor force participation rate comes back to over 65%, we expect business in the education loan market to continue to increase, a boom for ARM companies servicing that sector.

It’s clear that as the U.S. economy ends its five year recession, there will be an increasing total household debt amount due to a larger borrowing capacity. The job market will create more stable full-time positions so fewer people will fail to pay back their debts due to lost employment or the fear of job loss.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)