In spite of intense concern among many credit and collection professionals about regulation impacting lending and recovery efforts, two underlying economic indicators point toward bluer skies and sunnier days ahead.

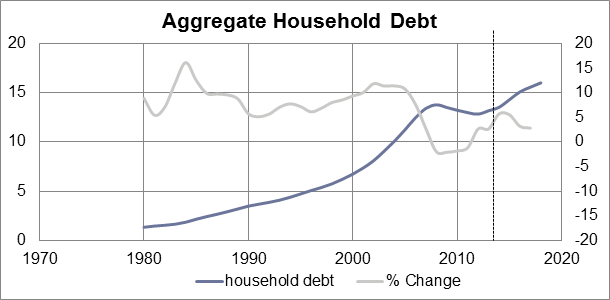

Aggregate Household Debt

The total amount of debt borrowed by U.S. households significantly decreased over the past five years, after consistently increasing for over 25 years. However, we feel this round of de-leveraging efforts by the American consumer has almost come to an end, a theory supported by the following trends:

- At the end of May 2013, the Consumer Confidence Index reached its highest level in the past five years.

- The personal saving rate dropped in the first quarter of 2013 below 3%, which was the common level before 2008. U.S citizens are reverting back to spending levels last seen before the financial crisis.

- Increasing housing prices allow real estate owners to borrow more money by refinancing, a trend that will continue as the housing market continues its upward trajectory.

In our latest report (request a copy here), we predicted that total household debt will stop decreasing by the end of 2013 and begin an upward trajectory until 2018.

The change in market demand for debt collection services is directly impacted by the change of the total household debt balance. As household debt increases, increased placement volumes are anticipated for ARM companies.

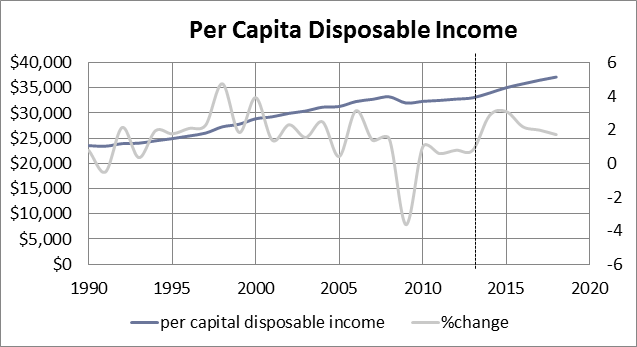

Disposable Income

Disposable income has been increasing at 1.75% per year, on average, from 1981 to 2012. The only two exceptions are in 1990 and 2009 and we know the challenges of those periods. We estimate that the disposable income level will continue to increase at a stable annual rate between 1.5% and 2%. Increased disposable income allows consumers to feel more comfortable borrowing more money. Historically U.S. consumers borrow at a rate that is equal to 5.5 times their disposable income. In 2018, the per capita disposable income is predicted to be over $37,000 per year (an increase of 13% in five years).

This supports consumers’ ability to pay back their debts and perhaps even more severely delinquent debt could be recovered, improving liquidation results.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)