Kaulkin Ginsberg Company, the leading provider of M&A and strategic advisory services for the Accounts Receivable Management (ARM) industry, has released its 2014 Accounts Receivable Management Mid-Year Review.

A few of the major findings released in the Review include:

The first six months of 2014 was a watershed for ARM companies and the chasm between those who will survive the next five years and those who will not is growing with each passing day. Consumer Financial Protection Bureau (CFPB) enforcement actions are at an all-time high, credit grantors are imposing compliance requirements more onerous than federal or state law, and the cost of compliance is quite literally driving many of the small- to mid-size operators out of business.

Credit cards were the leading growth sector of the U.S. ARM industry for the 15 years leading up to the start of the Great Recession. This market segment has been severely impaired as banks and other credit card issuers have significantly reduced vendor networks, de-emphasizing the importance of recovery performance and over-emphasizing adherence to compliance. The Review sheds light on leading growth markets over the next 24-26 months.

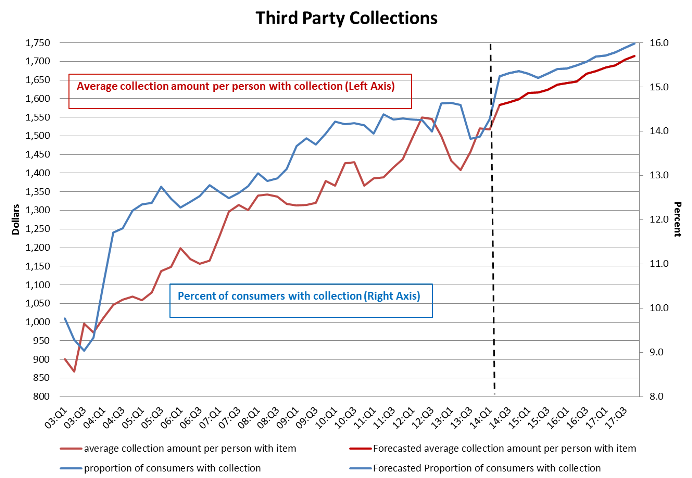

On a microeconomic level, and as this graphic illustrates, firms expect more consumers will wind up in collections and their average account balance will increase overall. A trend that bodes well for ARM companies positioned to receive the windfall of new placements.

Merger and acquisition transaction volumes have maintained current levels and expectations are that activity will accelerate as stricter regulatory conditions result in increased operational costs and client demands.

The Review covers critical topics impacting the ARM industry such as developments within major client sectors, macroeconomic factors, mergers and acquisitions, and makes predictions for the direction of the business. With the active involvement of Rozanne Andersen, the Review also provides critical and timely updates on compliance and regulatory affairs reshaping all aspects of the industry. A complimentary copy is available by request in the Reports section of www.kaulkin.com.

About Kaulkin Ginsberg

Since 1991, Kaulkin Ginsberg has provided value-add strategic advisory services tailored specifically to the accounts receivable management industry and other outsourced business services (OBS) companies. The firm’s client-centric approach covers almost every stage of a company’s lifecycle. For more about the firm please visit www.kaulkin.com.

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)