The utilities industry is not nearly as “sexy” as the healthcare or student loans segments, which always seem to be in the news. Despite the lack of publicity, the utilities industry deserves some attention because it presents opportunities for first- and third-party collection work as well as payment processing.

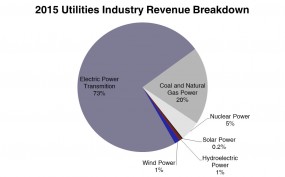

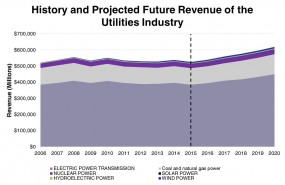

In 2015, the utilities industry is expected to generate approximately $526 billion in revenue and nearly $620 billion by 2020; that’s an almost $100 billion increase or an annual growth rate of 3.32 percent for the next five years. Electric power transmission, coal and natural gas, and nuclear power segments are driving this growth and they account for approximately 98 percent of all revenue in 2015.

In 2015, the utilities industry is expected to generate approximately $526 billion in revenue and nearly $620 billion by 2020; that’s an almost $100 billion increase or an annual growth rate of 3.32 percent for the next five years. Electric power transmission, coal and natural gas, and nuclear power segments are driving this growth and they account for approximately 98 percent of all revenue in 2015.

Although investments in green energy companies have increased over the last decade, there is still a long way to go before wind power is producing revenue at levels that appeal to the ARM industry.

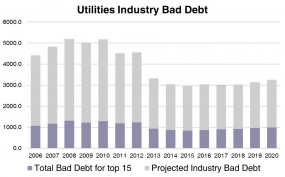

Breaking this market down further, Kaulkin Ginsberg projects bad debt will reach $2.12 billion in 2015 and will grow to more than $2.25 billion by 2020. During acquisition periods, utilities companies look to clear delinquent accounts off their books, elevating bad debt levels. Given that M&A transactions in this industry are expected to increase for the next three to five years, we anticipate a high level of delinquent account placements during this period. However, when consolidation occurs, more efficiency usually follows. Bad debt levels as a percentage of total revenue should fall over this period, but grow slightly in absolute value.

ARM companies considering entry into this market need to consider how regulations vary from state to state. On the one hand, this will present challenges to collection and compliance departments; on the other hand, ARM companies can choose which states they want to compete in based on state-specific regulations. That being said, few operations would or should choose to turn away business from states because they have stricter regulations than some of their neighbors.

This is an excerpt from Kaulkin Ginsberg’s upcoming market intelligence series on the utilities industry, available exclusively through KG Prime. For more information, or to inquire about our strategic advisory services, please email hq@kaulkin.com.

![Company logo for Kaulkin Ginsberg [Image by creator from Kaulkin Ginsberg]](/media/images/kgc-logo.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)