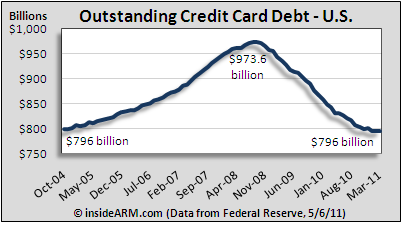

For only the second time in nearly four years, total credit card debt outstanding in the U.S. expanded in March 2011, according to data released by the Federal Reserve late Friday.

The Fed said in its monthly Consumer Credit data release (G.19) that revolving consumer debt, almost entirely comprised of credit card accounts, grew at an annualized rate of 2.9 percent – or $1.9 billion – in March to $796.1 billion. Credit card debt also expanded in December 2010, but had contracted in every other month since August 2008, when consumer credit card debt outstanding peaked at $973.6 billion.

The Fed said in its monthly Consumer Credit data release (G.19) that revolving consumer debt, almost entirely comprised of credit card accounts, grew at an annualized rate of 2.9 percent – or $1.9 billion – in March to $796.1 billion. Credit card debt also expanded in December 2010, but had contracted in every other month since August 2008, when consumer credit card debt outstanding peaked at $973.6 billion.

Many in the credit granting business have signaled that the long downward trend may be nearing a close. Capital One, in its quarterly earnings statement also released on Friday, noted that delinquencies were down and borrowing was increasing. “The period of shrinking loans through the Great Recession came to an end,” Cap One CEO Richard D. Fairbank said in a press release.

Non-revolving credit – like that found in auto and student loans – also expanded in March at an annual rate of 3 percent. Auto lending led the way in the non-revolving category. The Fed’s report does not include debt backed by real estate.

Total consumer credit outstanding was $2.425 trillion at the end of March.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)