Among the social media platforms ripe for business application in the ARM industry, the one most frequently met with misgivings (if not outright scorn) is Twitter. I’m a believer in Twitter’s use value as a business tool. For example, without ever Tweeting, one can consume the day’s important news and up-to-the-minute events much more efficiently than scanning a newspaper or two.

Among the social media platforms ripe for business application in the ARM industry, the one most frequently met with misgivings (if not outright scorn) is Twitter. I’m a believer in Twitter’s use value as a business tool. For example, without ever Tweeting, one can consume the day’s important news and up-to-the-minute events much more efficiently than scanning a newspaper or two.

If you run a debt collection agency, this means you can hop onto Twitter, quickly figure out what’s happening in the world that you need or want to pay attention to, and move on to more important stuff: you know, like your day job.

But this article really isn’t about social media or 140 character Tweets: it’s about student loans.

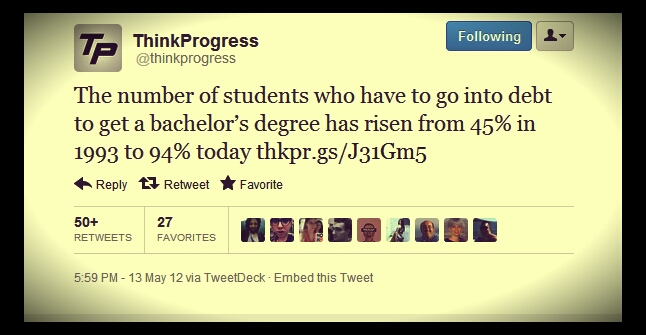

And it just so happens that through a social media platform like Twitter, via a source* of information that may not rank among the Top 10 (Top 100?) news outlets for ARM professionals, comes a pretty consequential message whether you’re a student loan debt collector or a parent about to send your kid to college:

And the message, in case you missed it is this: student loan debt is a growth industry.

*Editor’s Note: The @thinkprogress Tweet on student loan debt was derived from the recent @nytimes series Degrees of Debt.

Michael Klozotsky is the Chief Content Officer at insideARM.com. You should follow him on Twitter where he shares pretty much everything he knows that’s relevant to ARM companies, social media and marketing tips for business, and a little bit of nonsense now and again.

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)