Compliance Management is a hot topic going into the holiday season. Laws have changed, new regulations are in the works, and nearly every organization in the business of collecting debt is feeling some pressure.

Has your company put measures in place to avoid violating the rules that federal and state governments have issued for our industry? A recent survey to insideARM.com users shows some interesting results when it comes to compliance and complaints management, and what organizations such as yours are doing to take control of all-things-compliance. Survey respondents include compliance and collection management professionals employed at ARM agencies of all sizes. Following, we highlight some of the key findings…

Keeping Track of Consumer Complaints

One of the main goals of the Consumer Financial Protection Bureau (CFPB) is to reduce consumer frustration with financial products and services in the marketplace. The CFPB offers ARM organizations the ability to view consumer complaints related to their own collection efforts.

When asked if their companies had registered with Consumer Financial Protection Bureau (CFPB) to receive consumer complaints, 76 percent of survey respondents said that they had, while only 15 percent said they had not yet registered. Still, more than a few ARM organizations claim they did not know they were required to do so, which shows that education is still an important goal in our industry.

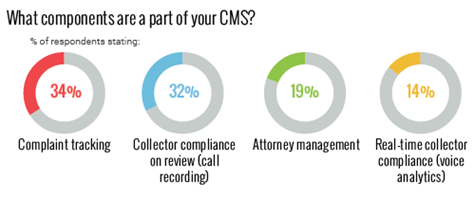

The vast majority of respondents currently have a complaint tracking system of some sort in place (82 percent), while about half of the survey participants say they have a Compliance Management System (CMS) in place. With help from a CMS, ARM firms can track complaints, monitor key compliance processes, store related documents and maintain a central system for managing an organization’s compliance requirements.

CMS Technology at Work

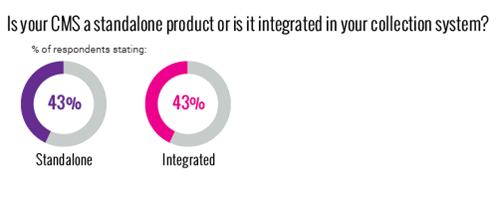

A good Compliance Management System can provide a single point of global control for compliance managers, clients, and regulators to audit and review agency controls employed to manage regulatory compliance. The survey posed several questions specifically about survey participants’ CMS capabilities and technology.

Compliance Counts

For most companies, “tracking” goes beyond tracking consumer complaints. Many organizations track their clients’, vendors’, and/or suppliers’ compliance standards as part of managing their overall compliance activities. While roughly half of the respondents already have a way to track at this level, as much as 30 percent of the respondents do not yet have this level of tracking in place.

Another key area of compliance is call monitoring. Prevention and early detection are essential to staying compliant. Having the tools to quickly identify and correct compliance deficiencies at an early stage helps managers resolve staffing or training issues before they become a bigger problem. Good news on this front: nearly 90 percent of respondents said that they do, indeed, have some way to monitor collection calls for compliance.

What’s Your Answer?

Where does your organization fall when it comes to taming the compliance management beast? Perhaps you’re in need of a better way to manage multiple compliance-related functions from a single program environment. Some technology providers now offer automated CMS solutions that work hand in hand with your existing primary collection solution. When shopping for a CMS, you’ll want to consider these key areas of Compliance Management:

-

Comprehensive Agent Data/History

-

Training Systems/Document Repository

-

Call Monitoring/Calibration/Auditing/Reporting

-

Complaint Management

-

Legal Network Management

Looking for additional consultation on the implementation of a CMS solution that is customized to your work environment? Contact Columbia Ultimate today.

![[Image by creator from ]](/media/images/julie-melton-124081.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Thumbnail_Background_Packet.max-80x80_af3C2hg.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)