Over the first quarter of 2015, the number lawsuits filed by consumers claiming violations of the Fair Debt Collection Practices Act (FDCPA) is up compared to the same period in 2014, a reversal of a three year trend in those types of actions. TCPA cases are down in the same time frame, also a change from recent trends.

In March 2015, FDCPA lawsuits filed in federal court increased 3.2 percent compared to March 2014, according to data provided by WebRecon LLC. Over the first three months of the year, FDCPA lawsuits are up nearly 12 percent from the first quarter of 2014.

It marks a sharp reversal in FDCPA suits filing trends that began three years ago.

In the mid-2000s, the volume of FDCPA was relatively low, but increasing steadily. In 2008, however, FDCPA lawsuits surged. And for the next three years, filings increased at double digit rates.

That all ended in 2012, though, as FDCPA filing dropped for the first year ever. Each subsequent year has seen a decrease in FDCPA suits. It’s a slightly different story for TCPA lawsuits. In March 2015, lawsuits claiming violations of the TCPA decreased 9.2 percent from March 2014. Through the first three months of the year, TCPA suits are down 7.4 percent.

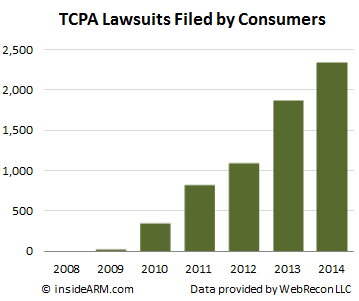

It’s a slightly different story for TCPA lawsuits. In March 2015, lawsuits claiming violations of the TCPA decreased 9.2 percent from March 2014. Through the first three months of the year, TCPA suits are down 7.4 percent.

But WebRecon noted that the gap between 2014 and 2015 TCPA filings is closing, and that they expect TCPA suits to catch up to year-over-year comparisons in the coming months.

TCPA lawsuits have grown very rapidly over the past several years. Five years ago, the TCPA was a minor blip on the radar of ARM compliance professionals. A dramatic increase in the usage of mobile phone usage in the U.S., combined with several other factors, has made the TCPA a much more enticing statute for aggrieved consumers and their legal representation.

TCPA lawsuits have grown very rapidly over the past several years. Five years ago, the TCPA was a minor blip on the radar of ARM compliance professionals. A dramatic increase in the usage of mobile phone usage in the U.S., combined with several other factors, has made the TCPA a much more enticing statute for aggrieved consumers and their legal representation.

While still far below the total volume of FDCPA suits, the increased focus on the telephone communications statute has left many ARM companies scrambling to bring their operations into sharper compliance.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)