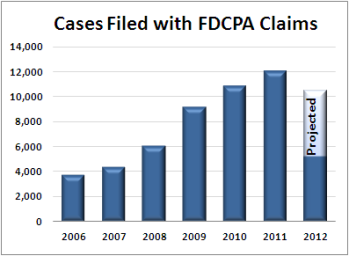

The total number of lawsuits against ARM firms filed in 2012 by consumers claiming violations of the Fair Debt Collection Practices Act (FDCPA) is now projected to fall under the number filed in 2011, according to a company that tracks the cases.

Even with a slight surge in FDCPA case filings in the first half of October, the total number of such suits filed in 2012 is 8 percent below those filed at the same point in 2011.

“We can now project FDCPA claims will finish the year at around 10,500 suits, down from 12,018 in 2011,” said Jack Gordon, whose company, WebRecon LLC, tracks suits filed under consumer statutes.

FDCPA cases filed in 2012 have been tracking lower than 2011 for most of the year. But around mid-year, it became apparent that 2012 could see a year-over-year decline.

If the total number of cases claiming violations of the FDCPA does decrease in 2012, it would mark a turnaround in the meteoric rise in such cases over the past few years.

If the total number of cases claiming violations of the FDCPA does decrease in 2012, it would mark a turnaround in the meteoric rise in such cases over the past few years.

But lawsuits against ARM firms claiming violations of other statutes have filled the void this year. For example, Gordon says that suits filed under the Fair Credit Reporting Act (FCRA) and Telephone Consumer Protection Act (TCPA) will be far higher in 2012 than in 2011. As it stands now, TCPA suits are up 50 percent from 2011 while FCRA suits are up 16 percent.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)