Earlier in 2013, insideARM.com, in cooperation with BillingTree, conducted a survey of collection agency operations professionals. The purpose of the survey was to gauge the usage of collection technology solutions and the priorities of decision-making ARM professionals as the industry navigates a shifting business environment.

The results revealed an ARM industry with major operational and strategic differences based on size. While the vast majority of collection agencies made use of some similar technologies (taking check payments by phone, for example) and had concerns about certain external forces that have recently emerged (CFPB regulation), when we broke the results out by company size, some real differences began to show.

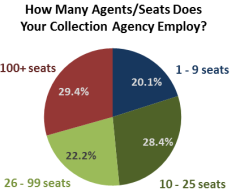

Nearly 200 debt collection operations professionals took the survey over a two week period. In an effort to better understand the segmentation of the respondents we wanted to determine the various sizes of the organizations responding to the survey. To do so we asked how many seats or collection agents were employed.

Respondents were given 4 categories to choose from: 1-9 seats, 10-25 seats, 26-99 seats, and 100+ seats. The results indicated the respondent pool was fairly evenly split amongst the four possible choices; 29.4 percent of collection agency respondents were from organizations with more than 100 seats, 22.2 percent with 26-99 seats, 28.4 percent with 10-26 seats, and 20.1 percent with between one and nine collectors.

Respondents were given 4 categories to choose from: 1-9 seats, 10-25 seats, 26-99 seats, and 100+ seats. The results indicated the respondent pool was fairly evenly split amongst the four possible choices; 29.4 percent of collection agency respondents were from organizations with more than 100 seats, 22.2 percent with 26-99 seats, 28.4 percent with 10-26 seats, and 20.1 percent with between one and nine collectors.

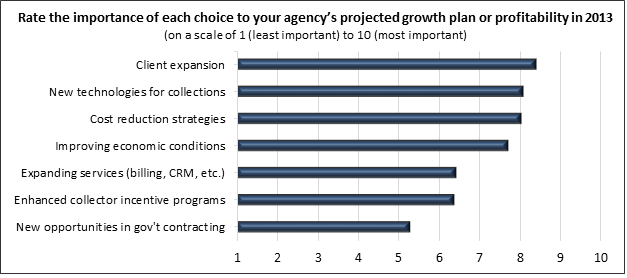

With the constant challenge of growing a business in a competitive market with an ever changing landscape we wanted to learn more about how various companies work to drive growth. It appears the feedback was consistent regardless of company size.

We analyzed the specific strategies respondents were looking to execute to address growth and profitability in 2013. The responses were again fairly consistent across company size. We found the most important tactical component of the overall strategy for growth and profitability lay in client expansion, followed by the prospect of introducing new technologies to improve collection efficiency.

There were other examples of collection agencies responding in lockstep, regardless of size. For example, no one was especially keen to use Social Media to contact consumers. But we also saw responses varying based on organizational size.

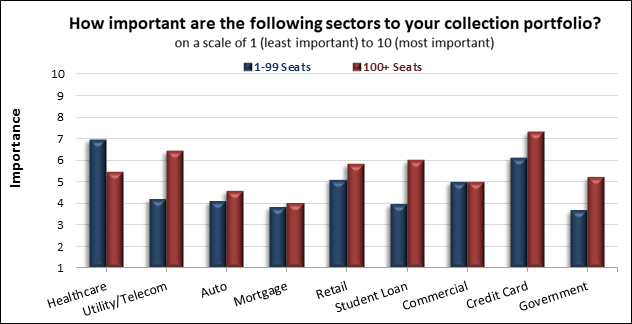

Most notably, when asked to rate the importance of different asset classes to a company’s overall collection portfolio, we found that companies in the three smaller categories were similar. But the larger collection agencies (100+ collection agents) reported an emphasis on different asset classes.

The most important sector to larger collection agencies is bank card/credit card, while the smaller agencies (1-99 seats) cite healthcare as their most important sector. We also found there were vast differences in the importance of certain sectors (utility/telecom and student loan) between large and smaller agencies.

The difference in the importance of asset classes is most likely due to the prominence of very large, and thus very important, clients in the utility/telecom, student loan, and credit card space. While there are many local and regional utilities, major telecom accounts tend to be national. The same goes for student loans; there are a lot of colleges and universities across the country, but there is one massive contract for the Department of Education.

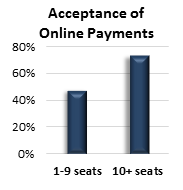

There were also differences on the other end of the size spectrum. When asked how collection agencies accept payments from consumers, the answers were relatively consistent across the choices and company sizes, except for one.

When the results were sorted by company size, a major discrepancy appeared in the online payment choice. The smallest agencies (1-9 seats) reported far lower use of the online payment channel to collect money (47.4 percent), while the larger companies used web payments at a much higher rate (73.2 percent). Even within the three large company categories there was a slight difference in usage, with the largest companies (100+ seats) using the online payment channel at a nearly 80 percent rate.

When the results were sorted by company size, a major discrepancy appeared in the online payment choice. The smallest agencies (1-9 seats) reported far lower use of the online payment channel to collect money (47.4 percent), while the larger companies used web payments at a much higher rate (73.2 percent). Even within the three large company categories there was a slight difference in usage, with the largest companies (100+ seats) using the online payment channel at a nearly 80 percent rate.

Similarly, there was a company size-driven discrepancy in the use of online or virtual debt negotiation technology. While only 14.1 percent of all participants in the survey said they used virtual negotiations, more than 23 percent of companies with 100+ seats use the technology, with another 31 percent saying they plan to use virtual negotiations in the near future.

The results make sense, in that larger companies have the resources available to experiment with and implement emerging technology, like virtual debt negotiation. The larger companies are also at an advantage with this particular technology because they have many more accounts in their portfolio. Likewise, smaller collection agencies may not want the cost of maintaining online payment systems or the seeming unreliability of counting on a consumer to self-service when every account is marginally more important to their bottom line.

The full results, and analysis, of the extensive survey can be downloaded in a free 20+ page whitepaper from BillingTree and insideARM.com.

Also, insideARM will be holding a free webinar next week, Thursday June 27, to further discuss the results. Register now.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)