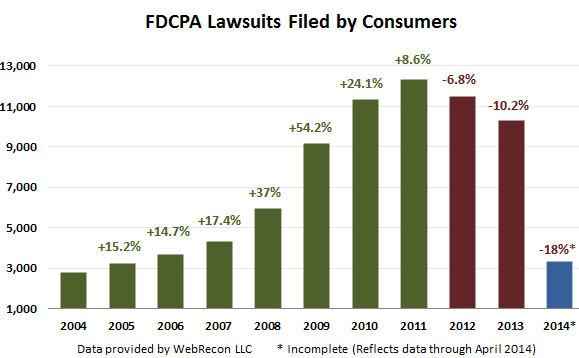

Lawsuits against ARM companies filed by consumers under the Fair Debt Collection Practices Act (FDCPA) are on track to decline again in 2014. If the trend holds, it would be the third-straight year of declines in total FDCPA lawsuits after years of rapid growth.

In the first four months of 2014, there have been 3,294 FDCPA cases filed in federal courts across the U.S. That number is 18 percent below the total at the same time last year, according to data provided by WebRecon LLC.

In April 2014 alone, there were 947 FDCPA suits filed, down 17 percent from April 2013, but actually up eight percent from the previous month.

FDCPA lawsuits filed against ARM firms rose rapidly from 2005 to their peak of 12,330 in 2011. Ever since then, fewer cases claiming FDCPA violations have showed up in the court system. Industry watchers had expected the rate of decline to slow as the “market” for plaintiff cases corrected. But it actually appears that the decline is accelerating.

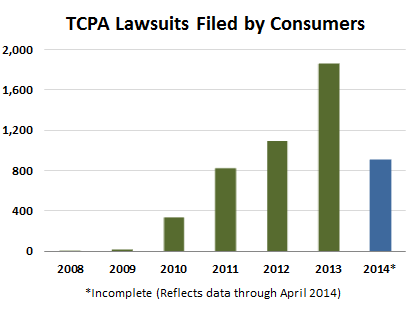

While FDCPA suits decline, cases claiming violations of the Telephone Consumer Protection Act (TCPA) continued their explosive growth in 2013.

TCPA cases were up nearly 70 percent in 2013. Consumers filed nearly 1,900 suits seeking remedy under the statute intended for telemarketers. In April 2014, there were 235 such cases filed, up 47 percent from April 2013. For the year, total TCPA lawsuits are up 46 percent from the same point last year.

The recent growth in TCPA lawsuits largely mirrors the increase in FDCPA suits seen in the middle and end periods last decade. In 2008, there were only 14 TCPA cases filed, followed by just 31 the following year. But beginning in 2010, consumers and their attorneys saw an opportunity and began focusing on TCPA cases. While the total number of cases is still dwarfed by FDCPA cases, the trend in filings has caused many ARM firms to shift legal resources.

The recent growth in TCPA lawsuits largely mirrors the increase in FDCPA suits seen in the middle and end periods last decade. In 2008, there were only 14 TCPA cases filed, followed by just 31 the following year. But beginning in 2010, consumers and their attorneys saw an opportunity and began focusing on TCPA cases. While the total number of cases is still dwarfed by FDCPA cases, the trend in filings has caused many ARM firms to shift legal resources.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)