How can ARM companies know where their market opportunities exist in the five to ten year time range? We all know that credit card debt is slowly recovering from recent lows and student loans are growing at a silly rate. But what about everything else?

The Federal Reserve Bank of New York has been engaged in a very interesting research project for more than a decade. Using a nationally representative 5 percent random sample of all Americans with a Social Security number and a credit report, the FRBNY analyzes Equifax credit report data looking for tradelines placed on the reports by creditors, servicers, and debt collectors. They go a step further and sample all other people living at the same address as the primary sample members to get a true picture of household credit and debt. The result is a report that includes data from 40 million Americans each quarter.

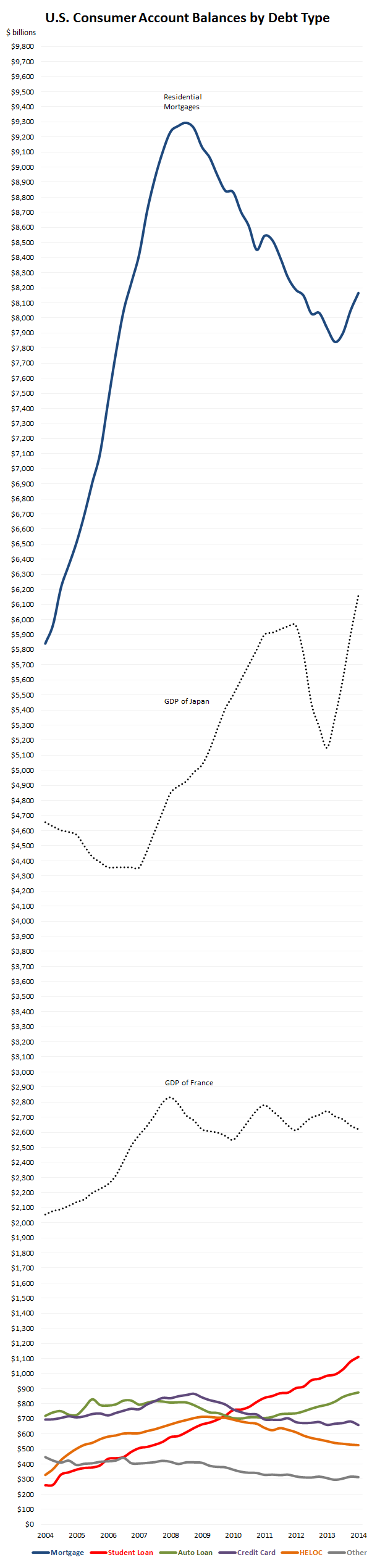

Examining the quarterly data back to the first quarter of 2003 reveals a trend in the growth of student loan debt, of course, that does not match any other type of debt. In fact, the growth in student loan debt over the past 11 years does not seem to be vulnerable to any of the economic forces that caused so much turbulence in the other markets.

But auto loans are once again growing at a nice clip as well. And mortgage debt has started to grow again.

For a visual of this growth, look at the very large image below. For reference, the GDPs of a couple of major countries are included (although that measures entirely different things):

It’s important to note that the purview of the Fed’s research covers only financial debt. That is, debt that is incurred as a result of a consumer credit contract. Not covered in these numbers are other types of debt like medical, telecom, and utility.

Interestingly, the New York Fed might offer a clue in its prose on the data. The report notes that only a small proportion of collections are related to credit accounts, with the majority of collection actions being associated with medical bills and utility bills.

Debt collection complaints coming into the CFPB also corroborate this idea. In the first quarter of 2014, only 22.7 percent of all debt collection complaints were about credit card accounts. Nearly 10 percent were related to medical debt and another 26.7 percent were put in the “Other” category, which includes phone, health club, and utility accounts. Another 21.5 percent weren’t classified at all.

So the debt collection industry is already shifting a lot of its work to non-financial debt. We’ll see if the trend continues in the years to come.

This article originally appeared in the latest issue of Know Your Debtor, a free quarterly newsletter focused on the U.S. consumer environment. Make sure you’re registered to receive insideARM’s newsletters on your User Profile page.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)