The Federal Reserve said late Friday that overall U.S. consumer credit outstanding grew to an all-time record in October, primarily on the strength of student and auto loans and credit cards.

Total consumer credit outstanding hit $2.753 trillion and rose at an annualized rate of 6.2 percent in October, the highest reading ever on the Fed’s monthly Consumer Credit report, also called the G.19. The report does not track debt backed by real estate.

All categories of consumer debt were up, with non-revolving debt (like that seen in auto and student loans) leading the way with a 6.9 percent annualized increase. Non-revolving debt outstanding was $1.895 trillion in October.

The strong rise in borrowing came in a month when American cut back on consumer spending, reflecting in part disruptions from Superstorm Sandy.

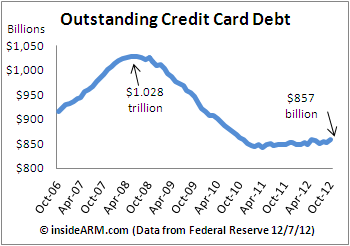

For only the second time in the past five months, credit card debt also increased. Revolving debt grew a total of $3.4 billion in the month, or at an annual rate of 4.7 percent. Total consumer credit card debt outstanding was $857.6 billion in October, the second-highest reading since credit card debt began to rebound roughly two years ago after a long and steep multi-year decline.

For only the second time in the past five months, credit card debt also increased. Revolving debt grew a total of $3.4 billion in the month, or at an annual rate of 4.7 percent. Total consumer credit card debt outstanding was $857.6 billion in October, the second-highest reading since credit card debt began to rebound roughly two years ago after a long and steep multi-year decline.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)