Lending institutions in the United States reported a 16 percent increase in their credit card chargeoff rates in the third quarter of 2011, according to data released last week by the Federal Reserve.

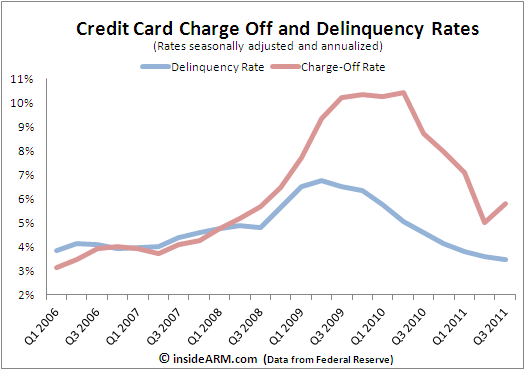

The Fed said that its member banks reported a seasonally adjusted, annualized credit card charge-off rate that averaged 5.81 percent in the third quarter, up from 5 percent in the second quarter. The average writedown rate was, however, drastically lower than the 8.71 percent rate reported in the year-ago period.

Since peaking at 10.44 percent in the second quarter of 2010, the average credit card charge-off rate has steadily and precipitously declined each quarter as financial institutions shed bad debt to shore up balance sheets. The spike in the third quarter of 2011 is the first increase in five quarters.

Credit card delinquencies touched a fresh low since the financial crisis, averaging 3.47 percent in Q3 2011, down 4 percent from the 3.62 percent rate reported in Q2 2011. It was the lowest credit card delinquency rate in more than 16 years, and the fourth lowest quarterly rate since the Fed began tracking the data in 1991.

Card delinquencies have been steadily declining over the past two years, also due to structural changes at lending institutions. After the liquidity crisis of 2008 and 2009, banks tightened credit card lending standards and greatly reduced available credit limits for most consumers, concentrating new offers to only the most creditworthy customers. As a result, delinquencies dropped steadily and continue to move downward.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)