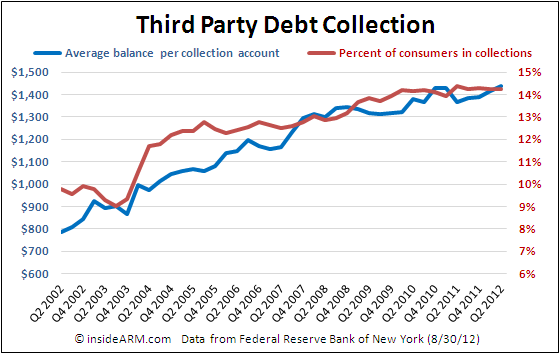

The Federal Reserve Bank of New York (FRBNY) Thursday released data that showed the average account balance of people that are currently in the third party debt collection process increased to $1,550 in the second quarter of 2012, the highest reading ever reported.

In its Quarterly Report on Household Debt and Credit, the FRBNY said that 14.25 percent of Americans currently have at least one account being handled by third party debt collectors, a percentage that has been essentially flat over the past four quarters. The average balance of those accounts is $1,550, up from $1,497 in the first quarter of 2012 and the first time the average has been above $1,500.

The average balance of accounts in collection spiked in 2010 and fell sharply at the beginning of 2011. It has been steadily increasing since then, and in the first quarter of this year overtook its previous high-water mark.

The quarterly report also showed that most types of loans and credit products are experiencing declines in 90+ day delinquencies, a leading indicator for the ARM industry. Credit card severe delinquencies fell 3.3 percent in Q2 2012 compared to the previous quarter, auto loan delinquencies dropped 6.8 percent, and mortgage arrears fell 5.1 percent. But student loan 90+ day delinquencies increased 2.6 percent quarter-over-quarter.

The FRBNY report noted that since the peak in household debt in the third quarter of 2008, student loan debt has increased by $303 billion, while other forms of debt fell a combined $1.6 trillion.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)