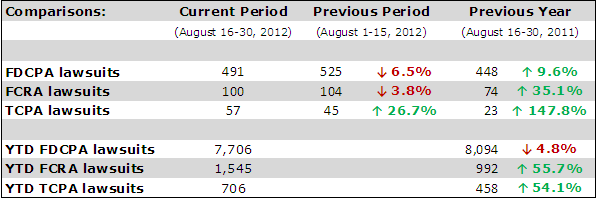

The number of lawsuits filed against accounts receivable management firms claiming violations of the Fair Debt Collection Practices Act (FDCPA) fell in the second half of August, mirroring a broad trend of declines in FDCPA suits in 2012 compared to 2011.

From August 16 to August 30, 2012, suits filed by consumers claiming violations of the FDCPA fell 6.5 percent percent compared to the previous period (the first half of August).

FDCPA lawsuits are down nearly 5 percent in 2012 compared to the same point in 2011. And with just four months to go in 2012, it appears that this year will mark the first decline in FDCPA lawsuits.

But lawsuits claiming violations of the Fair Credit Reporting Act (FCRA) are up 55 percent over this time in 2011 and Telephone Consumer Protection Act (TCPA) suits have also increased nearly 55 percent. TCPA suits, in fact, saw a spike in the second half of August.

FDCPA and Other Consumer Lawsuit Statistics, August 16-31, 2012 (provided by WebRecon LLC)

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Thumbnail_Background_Packet.max-80x80_af3C2hg.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)