China based Cinda Asset Management (Cinda) began trading on the Hong Kong Stock Exchange this week, underscoring a significant market change that has seen this company, originally created by the Chinese government to buy bad loans and other distressed assets, emerge as one of the fastest-expanding independent companies in China’s financial sector. Let’s take a look.

Cinda is described as an asset management company (AMC) in China. But it is actually an accounts receivable management company. Established in 1999, Cinda was one of 4 AMCs created by the Chinese government to deal with bad debts within China’s banking system. At that time, the only shareholder of Cinda was the Chinese Department of Treasury. In its traditional role, Cinda used government-backed funds to buy nonperforming loans from Chinese banks.

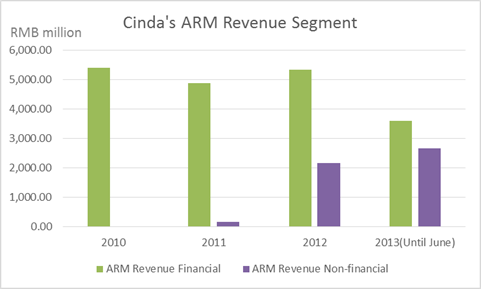

Early in 2010, Cinda became the first AMC to get permission to transfer itself from a government agency to a stand-alone business unit in China’s economy. In June 2010, Cinda brought on four outside investors including China’s National Council for Social Security Fund, UBS AG, CITIC Capital and Standard Chartered Financial Holdings. Currently, four AMCs are the major players in China’s debt collection and debt purchase industry. Cinda is the only AMC which has the permission to purchase bad debt from non-financial firms.

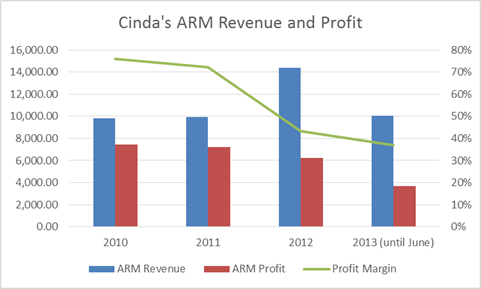

Based on its financial statement, ARM service accounts for 40% to 50% of Cinda’s total operational revenue in 2012. See chart below [all values expressed as Chinese Yuan Renminbi (RMB) - 1 RMB = $0.16]. However, ARM business contributes more than 75% of its before-tax profit.

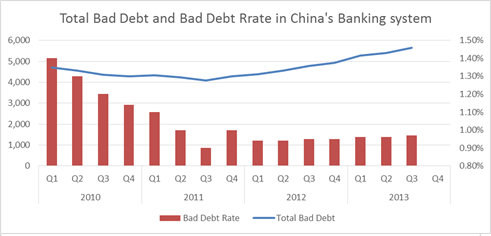

The bad debt rate in China’s commercial banks increased in the past 7 quarters, which created growth opportunities for the AMCs.

However, Cinda’s profit margin decreased in this period. Its profit margin dropped from 72% to 37% from Dec 2011 to June 2013.

China has a significant ARM opportunity in its future and Cinda is well positioned as the only firm currently permitted to purchase distressed non-financial assets in this vast country. And its government background positions it well in bad debt purchasing. We will continue to keep tabs on this company and the underlying market trends.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)