Part I of this series focused on characteristics of the millennial generation, the millennial’s communication preferences and the challenges and opportunities millennial present to those who collect debt. Part II of this series focused on the unique characteristics of seniors and the challenges and opportunities they present from a debt collection perspective. Both Parts I and II sought to promote a better understanding of the two largest populations experiencing high levels of debt.

Part III of this series explores communication preferences and opportunities beyond the traditional paper letter and land line.

Communication beyond Print Letters and Land Lines – Virtual Communications

Understanding the virtual environment is as important to the third party debt collector as any other single topic facing the industry today. Understanding how, when and why people and businesses use the internet, social media, cell phones, e-mail, text messaging and smart phones to communicate, exchange money, find information and generally interact with the world is critical to an understanding of how and when the third party debt collection industry can and should interact with consumers using nontraditional forms of communication.

Social Media

To be clear, social media is not a synonym for the World Wide Web or the internet. Social media is a term that applies to a broad body of electronic communication conducted via the web. Wikipedia further explains, “Social media can take on many different forms, including Internet forums, weblogs, social blogs, micro blogging, wikis, podcasts, photographs or pictures, video (YouTube), rating and social bookmarking. Though often used interchangeably with the term social media, the technologies used to support social media include: blogs, picture-sharing, vlogs, wall-postings, email, instant messaging, music-sharing, crowdsourcing, and voice over IP, to name a few.

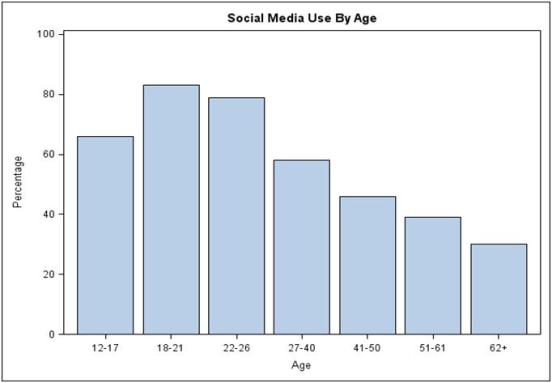

Many third party debt collectors are actively using several of these forms of social media to locate consumers, communicate with consumers, exchange information with consumers and accept payment from consumers. Knowing when to use social media to communicate with various demographic groups such as the millennials and the seniors will increase the value of social media within your organization.

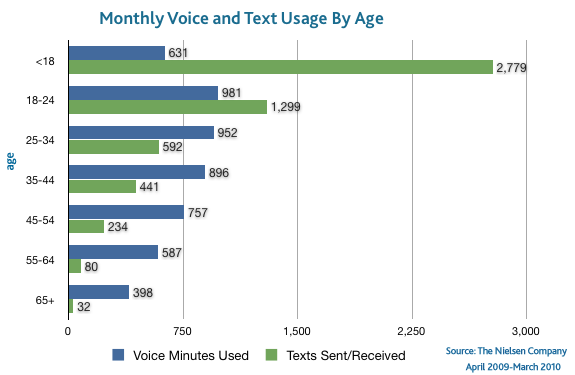

The millennials have a very short attention span. Above all other forms of communication, including voice, the millennials prefer text messaging and social media. The younger the person the more likely it is true they prefer text messaging over voice communication.

The millennials are extremely comfortable interacting with web sites. Unfortunately for the unwary, the three second rule, often applied by this same generation to an edible item that falls to the floor, also applies to their online engagement. They must be engaged within three seconds or they are gone. As recently as two years ago they were more tolerant. They would accept three clicks and eight seconds to engage. Those days are long gone. If you don’t grab their attention or provide them with the information they are seeking within three seconds you will have a difficult time attracting them back to your web site at any time in the future.

The 80/20 rule is also alive and well in the online world of the millennials. Nearly 16% of the online consumers generate 80% of the peer to peer online impressions. This means 20% of the people who post comments about your company on a blog influence the remaining 80% who read the blog and do not comment. Since the millennials generally trust their online peers over other sources, it behooves any business owner to follow and react to online discussions about your company or your competitors.

Text messaging and posting to online social media sites such as Facebook have surpassed email in volume as of 2010 and there is no evidence this trend will shift. It is estimated that by 2015 monthly traffic over mobile devices will be 26 times greater than it is today. The use of the smartphone is growing at the rate of 14% per year in the business sector and by 2014; smartphones will make up about two-thirds of all mobile phones sold in the United States.

Consumers and in particular the millennials are very comfortable using their phones to make mobile payments. Recent surveys show 45% of the global population and 26% of the U.S. adult population indicate they would use mobile payment methods. Mobile payments are predicted to reach $214 billion by 2015, up 68% from 2010 and are expected to rise 376% over the next three years. Products which allow bills to be paid using camera phones are on the market and new sites like BilltoMobile make mobile bill pay possible by just entering a phone number (AT&T). E-billing hubs like Doxo provide centers for billing and payment transactions and of course person to person payments are already transforming the market place by way of IPay technologies such as PoPmoney, etc.

In 2009, the number of electronic payment transactions reached $109.8 billion which far surpassed check transactions. The ability to make mobile payments will only increase the shift to e-payments. Any business strategy to increase recovery rates in the third party collection context must include a strategy to engage consumers in online payment programs via their smart phones.

![[Image by creator from ]](/media/images/rozanne-andersen-feb-2013.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)