The Servicemembers Civil Relief Act has added an additional layer of risk associated with pursuing active service member debt. Attorney General Eric Holder has made it clear that the Department of Justice and the newly formed Consumer Financial Protection Bureau will be active in enforcing the regulations. “Every day, our brave men and women in uniform make tremendous sacrifices to protect the American people from a range of global threats – and my colleagues and I are determined to ensure that they receive our strongest support here at home.”

Many service member debts qualify for protection under The Service Members Civil Relief Act and therefore must meet complex legal requirements. The best way to minimize the additional risk associated with this heavily regulated segment of debtors is through pro-active diligence, education, and a strong understanding of The SCRA.

The SCRA was designed with the intention to help and protect military service members and their families in times of financial hardship during active duty deployment. Recently, the United States Justice Department has made it perfectly clear that they are willing to use every tool at their disposal to fully administer the law when they prosecuted and fined Capital One for their violation of The SCRA.

The SCRA provides significant protections against wrongful foreclosures, court judgments, improper repossessions of vehicles, and denial of the guaranteed six percent interest rate The SCRA grants to service members on qualified loans.

Capital One was accused of numerous violations of the SCRA from 2006 to 2011. After investigation, it was discovered that the company denied service members the guaranteed 6 percent interest rate on credit cards and car loans and did not provide interest rate benefits even after receiving service member requests. In addition, they were found to have foreclosed on homes and repossessed cars on service members without court orders, and obtained debts owed on credit cards, mortgage foreclosures, and vehicles without filing accurate record of military service.

Capital One has since agreed to pay nearly $7 million in damages and provide a $5 million fund to compensate affected parties who did not receive appropriate SCRA benefits on their loans to resolve the issue.

The Consumer Financial Protection Bureau Office has also stepped up SCRA enforcement. In a landmark settlement, the country’s five leading mortgage servicers and lenders; GMAC, Bank of America, Citi, JPMorgan Chase and Wells Fargo, were forced to aid borrowers, grant loan modifications, and compensate homeowners who lost their houses to foreclosure due to violations of The SCRA.

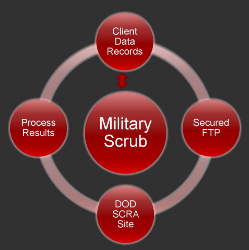

Debt Collection has always been a challenging industry, with “performance” being a key metric of success. Today, with the onslaught of federal and state regulation, “compliance” seems to be the ONLY metric of interest. Active duty service members have additional protections under The Service Members Civil Relief Act. If a company violates them, there are significant penalties. Having a reliable military scrub service can help eliminate the additional costs and regulatory burdens associated with the failure to follow SCRA guidelines.

Debt Collection has always been a challenging industry, with “performance” being a key metric of success. Today, with the onslaught of federal and state regulation, “compliance” seems to be the ONLY metric of interest. Active duty service members have additional protections under The Service Members Civil Relief Act. If a company violates them, there are significant penalties. Having a reliable military scrub service can help eliminate the additional costs and regulatory burdens associated with the failure to follow SCRA guidelines.

Rick Olejnik is the CEO of Surefire Data Solutions and the CISO of Rausch, Sturm, Israel, Enerson & Hornik. He is based in Milwaukee, Wisconsin.

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)