The U.S. insurance market is expanding, creating dynamic growth opportunities for ARM companies. As the economy continues to improve, several key factors are positively impacting the insurance market:

- Growth of the stock market

- Improving labor market conditions

- Shifting U.S. demographics

- Expected growth in consumer spending.

The U.S. insurance market generated more than $2.2 billion in total revenue in 2014. This market is intriguing in the way that bad debt is not as critical to the success of ARM operations because there is such a high volume of billing, coding, claims processing and other non-bad debt collection services. It provides ARM companies diversification in industries served in addition to diversification in the type of collection and other outsourced services.

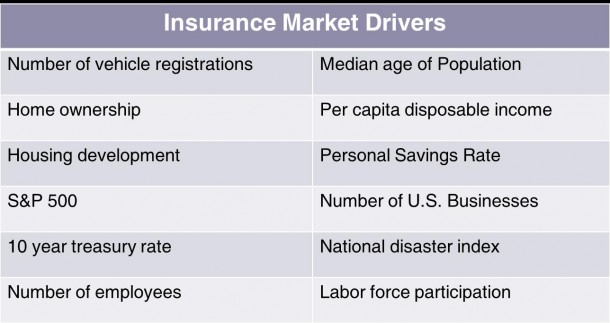

Many markets are covered by the insurance industry, so it isn’t surprising that there are a number of drivers impacting this market segment. The list below contains the major economic indicators that affect the insurance market and – indirectly – the ARM industry that serves this market:

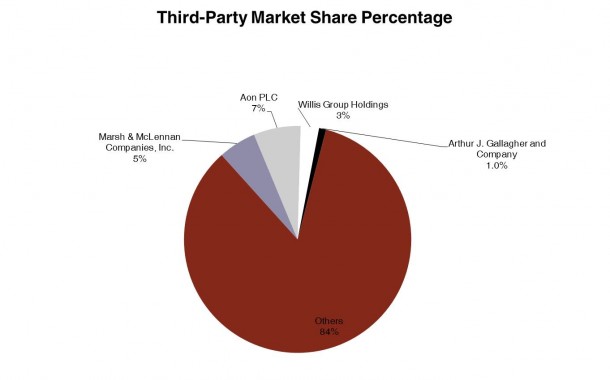

Outsourced services for this market are highly fragmented and have tremendous opportunities for agencies offering billing, coding, collections and call-center capabilities. The top five competitors only account for 15.7 percent of the third-party administrative services market. Moreover, the “other” competitors include companies like PWC, Accenture or Deloitte, who are far from specialists in this field and only provide these services as an extra consultative offering to their existing and prospective clients.

Like all markets, regulators are involved. Although there are varying degrees of regulation based on the segment of the insurance market, drastic changes to the current policy are not likely. This is because of the market’s maturity. The life insurance & annuities and property & casualty insurance segments are highly involved in the financial services sector, and health insurance is a hot-button issue for politicians ever since the launch of Obamacare.

Interested businesses should anticipate oversight from the CFPB, FTC and SEC. However, ARM companies engaging in third-party services like billing, collections, payment processing and call-center work shouldn’t experience any more scrutiny than what they already face, especially if they currently serve the banking and financial services industry.

![Company logo for Kaulkin Ginsberg [Image by creator from Kaulkin Ginsberg]](/media/images/kgc-logo.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)