Nearly seven years after the onset of the Great Recession, we are only now beginning to reach pre-recession levels of economic activity. The U.S. ARM industry has been forever changed. As strategic planning is a big focus in the fall for most executives, here are some of our mid-year predictions for the ARM industry:

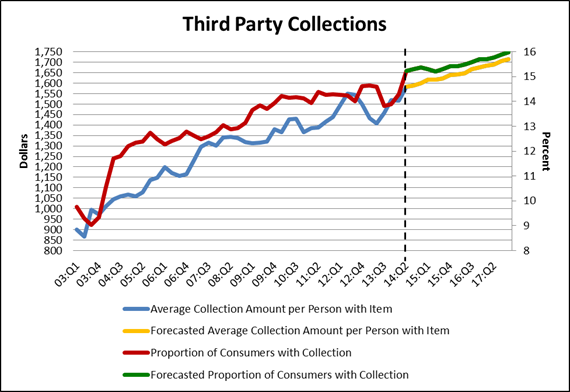

Prediction #1 – As this graphic illustrates, we expect that more consumers will wind up in collections, and the average account balance will increase overall, trends that bode well for ARM companies well positioned to receive the windfall of new placements.

Prediction #2 – We expect to experience a strong wave of consolidation within the ARM industry over the next 24-36 months as the increasing cost of compliance sets in and smaller and midsize service providers find it increasingly more challenging to operate profitably as a stand-alone business.

Prediction #2 – We expect to experience a strong wave of consolidation within the ARM industry over the next 24-36 months as the increasing cost of compliance sets in and smaller and midsize service providers find it increasingly more challenging to operate profitably as a stand-alone business.

As a part of this trend, we anticipate mergers to occur among the trade associations that service U.S. collection agencies, debt buyers and/or collection law firms as membership totals drop amidst consolidation, start-up replacements become less frequent, and lobbyist costs escalate to confront escalating regulation.

Prediction #3 – The ARM industry will again attract attention from private equity firms and other financial-type buyers, fueled by several trends in particular:

- Aging populations require more specialized services that ARM companies provide.

- Companies and governments continuing to seek ways to better manage their costs by outsourcing non-core services to ARM specialists.

- Stricter regulation and client compliance requirements are creating consolidation opportunities within certain markets and scalable competitive advantages that insulate and enable well positioned companies to operate profitably in a less competitive environment. The intense regulatory environment is creating, for the very first time in the ARM industry, a true barrier-to-entry in the U.S. ARM industry.

Prediction #4 – On the debt buying side:

- Expect even more cross-border M&A transactions involving US debt buyers seeking expansion by moving into developed and/or emerging credit economies

- Because debt buyers require nearly complete data in order to satisfy regulators when purchasing debt portfolios in the secondary market, most transactions will occur at historically low prices or with the seller burdened with increased transaction risk.

- Expect to see some debt buyers who outsource their collections to acquire contingency collection agencies in order to comply with anticipated regulatory and client requirements.

- Sizeable debt buyers will look to embrace the benefits of tax inversion, expansion and decreased regulation through foreign acquisitions and potentially relocating their headquarters overseas.

Additional predictions were made in our 2014 Accounts Receivable Management Midyear Review. Click here to request your copy now.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)