Merger and acquisition (M&A) trends in the outsourced business services (OBS) remain stronger than the broader U.S. market overall. Let’s take a look at the numbers and examine developing trends as we approach the halfway point of 2013.

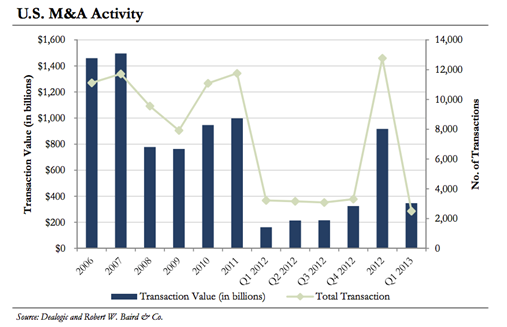

Across all market segments in the United States, approximately 2,500 U.S. M&A transactions were announced in Q1 2013, down nearly 25% from Q4 2012. This amount represented the lowest total number of transactions completed in the U.S. since Q1 2011.

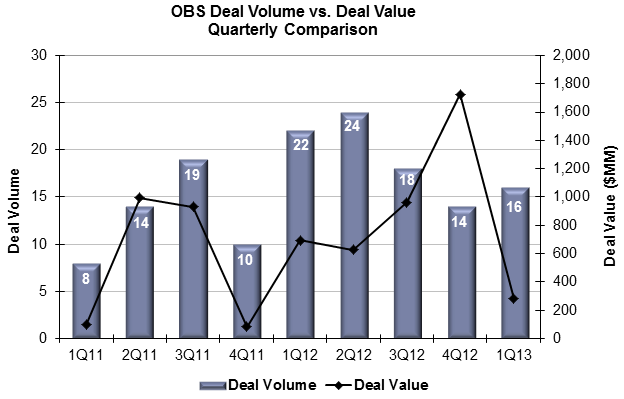

Within outsourced business services (OBS), which includes accounts receivable management (ARM), customer relationship management (CRM) and revenue cycle management (RCM), by comparison, 16 transactions were completed in Q1 2013, levels consistent with Q4 2012 in which 14 transactions were completed.

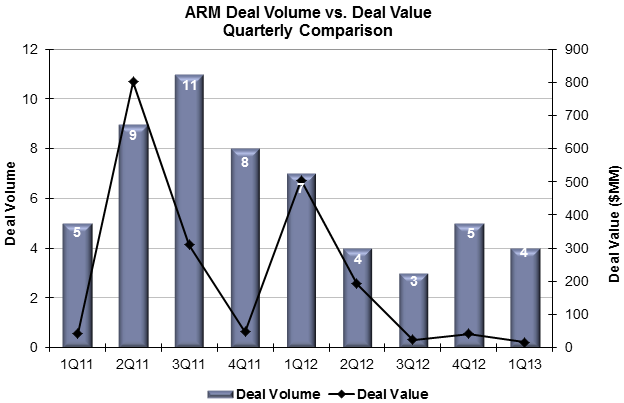

The global ARM industry experienced a significant downturn in M&A activity in 2012 driven by a growing level of uncertainty in the U.S. market coupled with stagnant liquidation results. 2013 appeared to be continuing this trend with only 4 transactions completed in Q1 representing $16 million in deal value, however activity picked up sharply in May with the announcement of two international ARM deals, Cabot Credit Management (CCM) and Interlaken Group, and Mike Barrist’s acquisition of Central Credit Services, Inc. and Radius Solutions, Inc. which was announced earlier this week, this on the heels of Encore’s announced acquisition of Asset Acceptance.

What should we expect to see as we look forward?

Although there is still plenty of uncertainty in the economy overall, we expect to see M&A activity accelerate as the year progresses. Financing conditions continue to be improving and many corporate buyers are hoarding large amounts of cash that can be used for acquisition purposes. Smaller companies, battling escalating operating costs and increased regulation, will find it harder to remain independent and may look more favorably toward a sale.

Due to volatile economic conditions over the past couple of years, larger OBS companies have been behind most of the acquisition activity, compared to financial-type buyers in the broader market. In Q1 of 2013, 75% of the transactions were less than $10 million purchase price, representing larger OBS companies acquiring smaller ones.

We expect that financial buyers in particular, which accounted for almost one third of all U.S. M&A transactions in Q1 2013, will be very active for the remainder of 2013. They are sitting on historically high amount of cash that must be put to work this year or be returned to investors.

The OBS sector will continue to attract considerable attention, fueled by these several trends in particular:

- Aging populations in several of the larger consumer markets that are requiring more services, particularly healthcare and government services.

- Companies and governments continue to seek ways to better manage their costs and will outsource non-core services to specialists.

- Stricter regulation and client compliance requirements are causing a consolidation in certain markets (i.e. financial services), and forming barriers to entry that will enable surviving incumbents to grow in a less competitive environment over time.

Please let me know if you want to confidentially discuss market trends, or your particular M&A interests.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)