Debt collection agencies saw earnings decline in 2012 compared to the previous two years, according to a financial benchmark report from insideARM.com.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) as a percentage of revenues was lower for each of the eight company size categories in the report except the very smallest, agencies with under $500,000 in annual revenue.

Not only was EBITDA down from 2011 to 2012, but the metric also fell well below EBITDA percentages for 2010. EBITDA is widely used as a measure of operational profitability for a company.

The Collection Agency Financial Benchmark Report 2013 draws information from a variety of public and private-sector sources, and aggregates data from 2,370 collection agencies. Results are reported among eight company-size categories, from agencies with less than $500,000 in revenues to those with revenue up to $100 million annually. The data in the report is from the full year 2012.

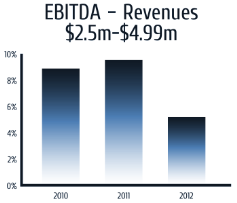

The graph at right shows the typical breakdown of EBITDA as a percentage of revenue over the past three years. This graph, which is included in the report, shows results for agencies with between $2.5 million and $5 million in annual revenue. EBITDA increased slightly from 2010 to 2011 and then sharply dropped off last year.

The graph at right shows the typical breakdown of EBITDA as a percentage of revenue over the past three years. This graph, which is included in the report, shows results for agencies with between $2.5 million and $5 million in annual revenue. EBITDA increased slightly from 2010 to 2011 and then sharply dropped off last year.

Graphs for other company sizes, also in the report, show a very similar pattern, except for agencies with less than $500,000 in revenue: they showed a very slight uptick in EBITDA in 2012.

The most likely culprit was increased expenses. As shown in other data in the report, operating expenses as a percentage of revenue soared in 2012 across most company sizes.

When the data is presented in real dollars, however, operating expenses were relatively flat. The real problem was a decline in revenue in 2012. Real revenue across most business sizes in 2012 was below the five-year average (2008-2012).

Blame the decline in revenue on persistently high unemployment, a nightmarish regulatory environment for both creditors and collectors, or on any other factor; it still appears that most ARM companies had less coming in last year.

For more financial results, check out the Collection Agency Financial Benchmark Report 2013 in the insideARM.com Research Library.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)