Despite a drop-off in severely delinquent credit, the percentage of Americans with at least one credit report trade line from third party debt collection agencies stayed near an all-time high in the second quarter of 2013, according to the Quarterly Report on Household Debt and Credit from the Federal Reserve Bank of New York.

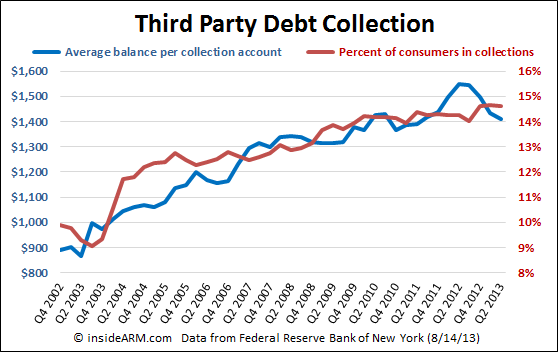

The New York Fed (FRBNY) reported that 14.60 percent of Americans had a third party collection action on their credit reports in Q2 2013, down very slightly from 14.64 percent in the first quarter, the highest rate on record.

The average balance on third party debt collection accounts continued to fall in the quarter. In Q2 2013, the average was $1,409 per account, down from $1,433 in the first quarter and well below the all-time high of $1,550 set in the second quarter of 2012.

The FRBNY report noted that accounts reported by third party debt collectors often have little bearing on overall consumer credit trends. The report says, “only a small proportion of collections are related to credit accounts with the majority of collection actions being associated with medical bills and utility bills.”

Consumers have been falling behind on credit accounts at a far slower pace over the past year.

In Q2 2013 total household indebtedness fell to $11.15 trillion; 0.7 percent lower than the previous quarter and 12 percent below the peak of $12.68 trillion in Q3 2008. Mortgages, the largest component of household debt, fell $91 billion from the first quarter.

“Although overall debt declined in the second quarter, households did increase non-housing debt, led by rising auto loan balances,” said Andrew Haughwout, vice president and research economist at the New York Fed. “Furthermore, households improved their overall delinquency rates for the seventh straight quarter, an encouraging sign going forward.”

The percent of 90+ day delinquent balance for all household debt declined to 5.7 percent from 6.1 percent in Q1. Additionally, the delinquency rate for every individual component of household debt declined from the first quarter: mortgages (4.9 percent from 5.4 percent), HELOC (3 percent from 3.2 percent), credit card debt (10 percent from 10.2 percent) and student loan debt (10.9 percent from 11.2 percent).

Other highlights from the report include:

- Outstanding student loan debt increased $8 billion to $994 billion.

- Credit card balances increased $8 billion to $668 billion.

- Total mortgage debt decreased to $7.84 trillion from $7.93 trillion.

- HELOC balances fell $12 billion to $540 billion.

- Mortgage originations rose to $589 billion, the seventh consecutive quarterly increase.

- 200,000 individuals had new foreclosure notations added to their credit reports, the first increase since Q1 2012 but still 65 percent below the peak in Q2 2009.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)