Jeff Dickey,

Persolvo Data Systems

Concerns about security, compliance and third-party communications still chief objections to utilizing debt settlement companies.

In each of the past two years, insideARM.com has conducted a survey of the ARM industry to better understand how these companies are utilizing debt settlement providers to increase collections [October 2011: Debt Settlement Survey: How Creditors and Collectors Increase Collections; January 2013: Debt Settlement Survey Round II: How Creditors and Collectors Increase Collections]. In each of these surveys, roughly 50% of survey respondents indicated that they now engage debt settlement providers as part of a strategy to locate collection accounts and increase collections through the use of these third party service providers. While this adoption is significant, still, roughly half of the firms responding to the surveys each of the past two years indicated that they still did not work with debt settlement companies as part of their collection strategy.

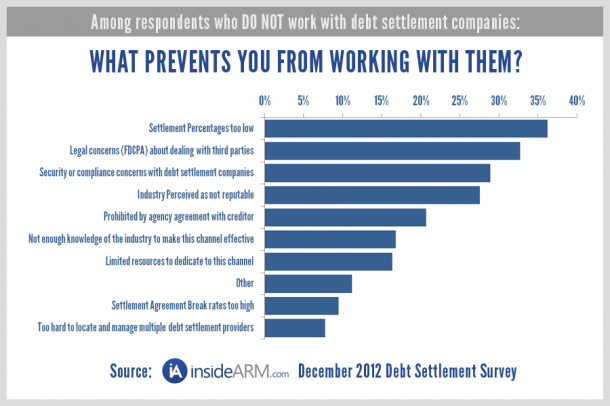

The most interesting observation of this data was the first six most commonly reported reasons for NOT working with a debt settlement company were exactly the same in order of importance in each of the last two year’s surveys. The second most interesting data point to emerge was only one of the top six reasons for not working with debt settlement providers related to the economics of the settlement or net recovery, while four of the five reasons were solely related to perceptions of security and compliance practices of debt settlement providers. Even the perceived reputational credibility of debt settlement providers ranked only fourth in concern as a reason for not working with the industry. This clearly illustrates that debt settlement companies need to do a better job of either coming into compliance in the same manner that creditors, debt buyers, legal recovery firms and collection agencies are required to do, or, the debt settlement industry as a whole needs to do a better job of demonstrating and communicating HOW they meet specific compliancy requirements pertaining to data security, the FDCPA, third‐party communications concerns, and recent regulations released by the CFPB that require service providers such as debt settlement providers to be able to demonstrate to debt buyers and collection agencies the efficacy and oversight of their policies and procedures in the area of consumer financial laws and data security.

In light of the focus on compliance in the ARM industry today, the implementation of the larger market participants rule and the recent requirements placed on ARM companies to ensure their service providers meet similar levels of security and operational compliance standards; it is no wonder more ARM companies are not embracing more debt settlement providers. To combat this lack of adoption, debt settlement providers should be proactive in demonstrating the value proposition they can deliver to collectors while simultaneously creating compliance programs verified through third party audits that demonstrate an adherence to industry standards relating to security and compliance.

As the ARM industry has consistently demonstrated over the past two years strong adoption in utilizing debt settlement companies, a clear strategy has begun to develop among buyers and collectors who understand the benefits of collecting through these third parties. With multiple companies offering a commercial service to collectors to identify consumers enrolled in debt settlement programs through the use of an aggregated database of debt settlement consumers, many buyers and collectors have developed a hybrid strategy of working directly with a few large debt settlement companies while also scrubbing collection files and submitting offers through third party debt settlement account aggregators. These debt settlement account aggregators provide a layer of security and compliance for buyers and collectors sharing data to locate accounts while delivering significant operational efficiencies through their databases that aggregates dozens and in some cases hundreds of smaller debt settlement providers, many of which are hard to locate and time consuming to deal with on a one-off basis.

If your firm is looking for new ways to recognize real value from collections files, trying to locate or contact consumers motivated to settle their debts and who are funding trust accounts for this purpose on a monthly basis and if your firm is seeking an enhanced layer of security and compliance when dealing with third parties in the debt settlement industry, consider a strategy focusing on consumers enrolled in debt settlement programs and select a commercial vendor that aggregates this data to make the process of working with this industry more efficient, compliant and profitable.

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)