After analyzing debt collection complaint data from the FTC, we thought it would be helpful to explain exactly what options are available to consumers making complaints.

After analyzing debt collection complaint data from the FTC, we thought it would be helpful to explain exactly what options are available to consumers making complaints.

Our understanding is that the FTC does not regularly distribute complaint data to subjects of complaints, unless the data is used against an ARM firm in a case that actually reaches the discovery process. So if you’ve never seen what’s behind the curtain, this will help to understand what’s there.

We received the data in the form of a spreadsheet; the information below details the columns in that spreadsheet, as well as the selection options provided for those fields that have selection boxes.

Complaint Sources

- FTC Call Center

- FTC Online Complaint Assistant

- BBB office (individual office listed)

- AG or Dept of Justice office (Individual office listed)

- PrivacyStar

Complaint Data Fields

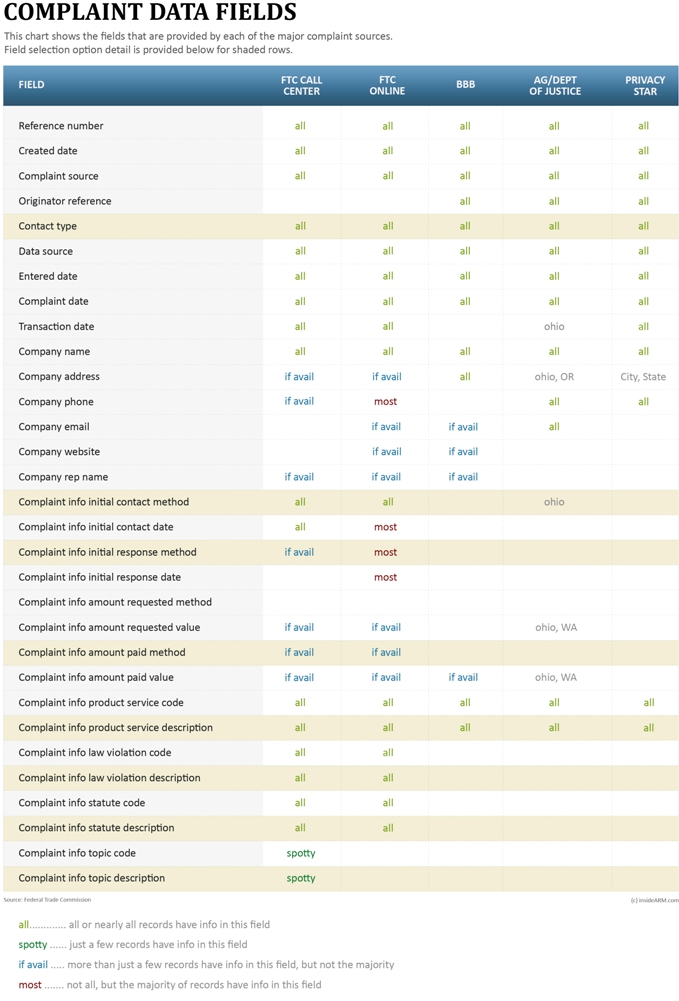

This chart shows the fields that are provided by each of the major complaint sources. Field selection option detail is provided below for shaded rows.

The following are selection options for the highlighted fields above.

The following are selection options for the highlighted fields above.

- Comments

- Complaint

- General Complaint

- Informant

- Request for Information

Complaint Info Amount Paid Method

- Bank account debit

- Bank money order

- Bank transfer other

- Cashier’s check

- Certified cheque

- Check (not classified)

- Check (personal)

- Traveler’s check

- American Express credit card

- MasterCard credit card

- Visa credit card

- Other credit card

- Visa cash advance

- Money order (not classified)

- Postal money order

- Wire transfer – Western Union

- Wire transfer – MoneyGram

- Not reported

- Other payment method

- Unknown

- Fax

- I initiated Contact

- In person

- Internet website

- Internet email

- Internet other

- Mobile: text/email/IM

- Phone

- Phone Call: Landline

- Phone Call: Mobile/Cell

- TV/Radio

- Unknown

- Wireless

Complaint Info Initial Response Method

- Answer cold call

- In person

- Internet email

- Mobile: text/email/IM

- Other

- Phone: other

- Phone: 800/888 number

- Phone: 900 number

- Phone: International call

- Unknown

Complaint Info Product Service Description

In many cases, the consumer – or FTC call center representative – has selected multiple items to describe a single complaint.

- Auto: Financing

- Auto: Sales – New

- Bank: National\Commercial

- Bank: State-Charter: FR Member

- Books

- Buyers Clubs (not travel or lottery)

- Credit Bureaus

- Credit Cards

- Credit Information Furnishers

- Credit Report Users

- Creditor Debt Collection

- Debt Management/Credit Counseling

- Health Care: Other Medical Treatments

- Health Care: Other Products\Supplies

- Home Appliances

- Housing

- Impostor: Business

- Impostor: Government

- Leasing: Business

- Lending: Banks & Credit Unions

- Lending: Finance Company

- Lending: Mortgage

- Lending: Other Institutions

- Lending: Student Loans

- Magazines

- Office Supplies and Services

- Office: Ad Space\Directory Listings

- Other (Note in Comments)

- Telemarketing, Other

- Telephone: Mobile Other

- Telephone: Mobile Rates/Plans/Advertising

- Telephone: Mobile Unauthorized Charges or Debits

- Telephone: Unauthorized Charges or Debits

- Television: Satellite & Cable

- Timeshare Resales

- Unauthorized Debits or Charges for Unknown Products

- Utilities

Complaint Info Law Violation Description

The following standard descriptions are used in conjunction with complaints labeled “third party debt collection.” We noted that, in numerous cases, multiple descriptions were used – often as many as five to ten of them for one complaint. To see which descriptions were the most frequently cited in January 2012 debt collection complaints, please read “Complaints About Debt Collectors Going After Wrong Debt Top List in January.”

- Calls any person repeatedly or continuously

- Calls Debtor After Getting ‘Cease Communication’ Notice

- Calls Debtor at Work Knowing Debtor Can’t Take Calls

- Calls Debtor Before 8AM or After 9PM or at Inconvenient Times

- Calls Someone Repeatedly to Obtain Debtor’s Location

- Collects Unauthorized Interest\Fees\Expenses

- Company does not provide any opportunity for consumer to opt out of information sharing

- Company fails to honor request to opt out/opt-out mechanism does not work

- Company is violating its privacy policy

- Deception/Misrepresentation

- Fails to Identify Self as Debt Collector

- Fails to Send Written Notice of Debt to Debtor

- Falsely Represents Character, Amount, Status of Debt

- Falsely Threatens Suit/llegal or Unintended Act

- Falsely Threatens Arrest, Seizure of Property

- FCRA: CRA\Furnisher – Improperly Conducts Reinvestigation of Disputed Item

- Refuses to Verify Debt After Debtor Makes Written Request

- SPAM: Other/general annoyance

- SPAM: ‘Remove Me’ is missing, broken , or ignored

- SPAM: Subject or From line is false or misleading

- Tells Someone Other Than Debtor About Debt

- TSR: Abandoning a telemarketing call

- TSR: DNC: Ignoring Your Prior Request to that Specific Entity

- TSR: Other Deception or Abuse (note in comments)

- TSR: DNC: Violating the Registry

- TSR: Telemarketing outside 8 a.m.-9 p.m.

- TSR: Unauthorized billing

- Uses obscene, profane or otherwise abusive language

- Uses or threatens to use violence

Complaint Info Statute Description

This field is populated by the consumer making the complaint or by someone working in the FTC’s call center. In many cases, multiple items are selected to describe a single complaint.

- CAN-SPAM Act

- Credit Practices Rule

- Equal Credit Opportunity Act

- Fair Credit Reporting Act

- Fair Debt Collection Practices Act

- FTC Act Sec 5 (BCP)

- Health Violations

- Home Repair Deceptions

- Mail or Telephone Merchandise Order Rule

- Rule/Other

- Telemarketing Sales Rule

- Unordered Merchandise

Complaint Info Topic Description

- Alleged email practice

- CA Debt Collector law

- Do Not Call

Related Content:

![Stephanie Eidelman [Image by creator from ]](/media/images/Stephanie_Eidelman-12.8.19.7e612703.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Thumbnail_Background_Packet.max-80x80_af3C2hg.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)